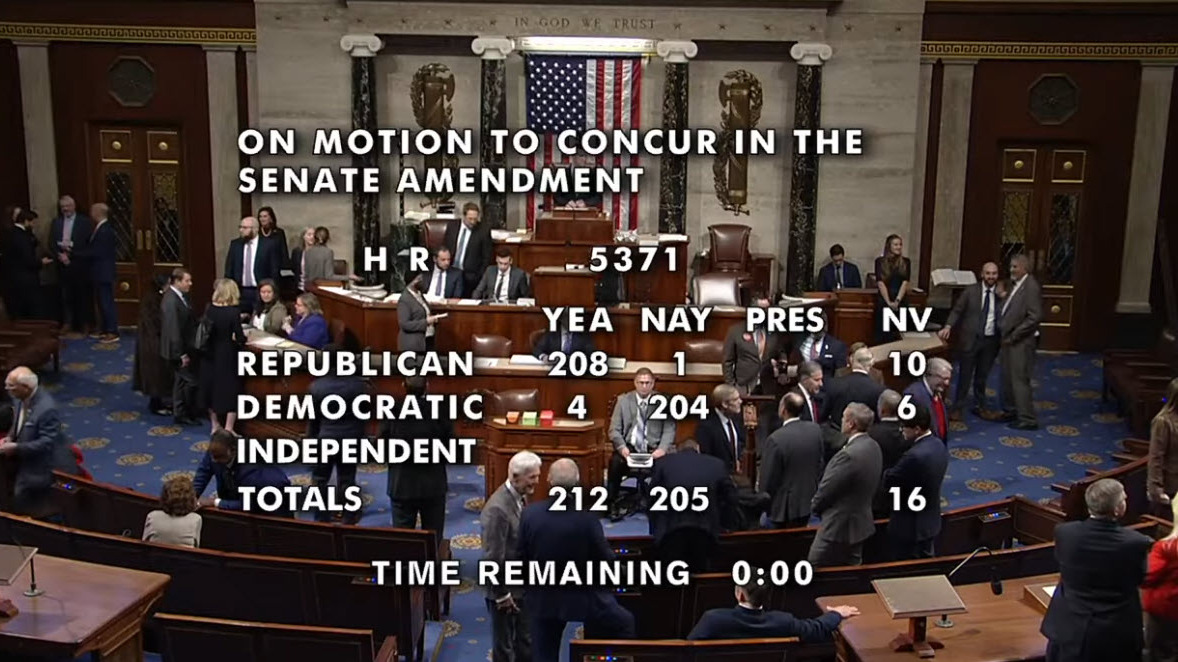

The federal government reopened late Wednesday after a 43-day shutdown, the longest in U.S. history, as Congress approved a short-term funding bill keeping agencies running through Jan. 30, 2026. (The Hill, Nov. 13)

State of Play

What’s Restored: NFIP, HUD Programs, Federal Services

What’s Next

Another shutdown is possible if Congress fails to meet the Jan. 30 deadline.

The new stopgap extends government funding only through Jan. 30, leaving appropriators less than two months to complete the remaining FY2026 bills. With the government reopened, housing, permitting, tax, and energy policy issues are again at the forefront of congressional debates. (PoliticoPro, Nov. 13)

Housing

Permitting & Energy

Tax and Tariff Policy

Roundtable on the Road

RER will continue working with lawmakers to provide insights and advance practical solutions as Congress moves into a compressed legislative window.

Blackstone announced this week that Kathleen McCarthy, global co-head of Blackstone Real Estate, will step down from the firm at the end of the year after an impactful 15-year tenure. As Chair of The Real Estate Roundtable (RER), she will continue to lead the organization’s policy agenda, member engagement and industry outreach. (Bloomberg | CoStar, Nov. 11)

Next on RER’s meeting calendar is the all-member State of the Industry (SOI) Meeting, which will include policy advisory committee sessions, on January 21–22, 2026, in Washington, DC.