When an individual dies, the U.S. levies a comprehensive tax on his or her wealth and assets, including unrealized gains, through the estate tax. When wealth exceeds an exemption amount it is generally taxed at a rate of 40%. Separately, for income tax purposes, the basis of assets in the hands of an heir is “stepped up” to fair market value at the time of the decedent’s death.

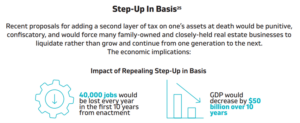

In recent years, there have been efforts from lawmakers to add a second layer of tax at death by imposing a capital gains income tax on a decedent’s unrealized gains, effectively repealing current law’s step-up in basis. The Real Estate Roundtable opposes these efforts.

Applying capital gains to appreciated property—at the same time that the tax code is applying a 40% estate tax to the asset’s full fair market value—is punitive and confiscatory, forcing many family-owned and closely-held real estate businesses to liquidate rather than grow and continue from one generation to the next.

In 2021, The Roundtable and other members of the Family Business Estate Tax Coalition commissioned EY’s Dr. Bob Carroll, the former Deputy Assistant Secretary of Treasury for Tax Analysis, to evaluate the economic consequences of eliminating step-up in basis. The report concluded that if step-up in basis were repealed, 40,000 jobs would be lost every year in the first 10 years after enactment, and GDP would decrease by $50 billion over 10 years.

The coalition’s report and sustained, coordinated advocacy, including letters to key lawmakers, played a central role in persuading Congress to retain longstanding tax rules that apply to assets transferred at death in recent spending packages.

For more information and recent updates, reference our resources below.