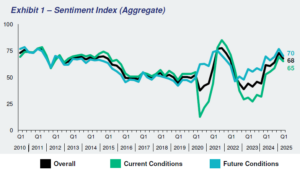

(WASHINGTON, D.C.) — The Real Estate Roundtable today released its Q1 2025 Sentiment Index, which registered an overall score of 68, reflecting a 5-point decline from the previous quarter. While industry leaders remain cautiously optimistic, fading expectations for additional interest rate cuts, rising insurance costs, and policy shifts under the new administration are shaping investment decisions. Despite ongoing challenges, survey respondents remain confident that transaction activity will pick up throughout 2025 as investors adjust to the new market realities.

Roundtable President and CEO Jeffrey DeBoer said, “The commercial real estate industry remains in a transitional period. Although interest rate adjustments have provided some relief, the reality is that capital markets remain constrained, and investors are being more selective. While there are signs of market stability, there is lingering uncertainty over tariffs, expiring tax cuts, and regulatory reforms that could slow investment and economic growth.”

He added, “There must be a supportive public policy environment that understands and addresses the multifaceted challenges the industry faces. The Roundtable remains committed to working with policymakers and the administration to advocate and demonstrate the importance of maintaining a policies that encourage capital formation, reward entrepreneurial risk-taking, and support jobs and communities.”

The Q1 Sentiment Index topline findings include:

Data for the Q1 survey was gathered by Chicago-based Ferguson Partners on The Roundtable’s behalf in January. See the full Q1 report.

The Real Estate Roundtable brings together leaders of the nation’s top publicly-held and privately-owned real estate ownership, development, lending and management firms with the leaders of major national real estate trade associations to jointly address key national policy issues relating to real estate and the overall economy.

# # #

Commercial Real Estate Executives Signal Increased Caution in Q2 Sentiment Survey

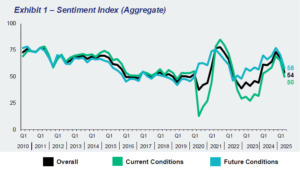

(WASHINGTON, D.C.) — The Real Estate Roundtable (RER) today released its Q2 2025 Sentiment Index, reporting a decrease in confidence in the commercial real estate market environment among industry executives due to policy uncertainty, rising costs, and cautious investor sentiment. The quarterly Sentiment Index, measuring executive perceptions on market conditions, asset values, and capital availability, declined to an overall score of 54, down 14 points from last quarter. The Current Conditions Index dropped to 50, reflecting a 15-point decline, while the Future Conditions Index decreased by 12 points, settling at 58. The Overall Index is scored on a scale of 1 to 100 by averaging Current and Future Indices; any score over 50 is viewed as positive.

RER President and CEO Jeffrey DeBoer said, “While respondents note early signs of market stabilization and improved transactional discipline, lingering concerns over U.S. trade policies and other economic headwinds are tempering optimism for the remainder of 2025. The office sector remains under pressure, but is experiencing a gradual rebound as return-to-office trends continue to shift closer to pre-pandemic patterns.”

He added, “Uncertain tariff policies are driving up construction costs and weighing on long-term investment decisions. At the same time, the Federal Reserve’s decision to hold interest rates steady is slowing capital formation and delaying needed transactions. We need pro-growth economic policies that encourage productive investment, strengthen communities, and promote long-term stability. Extending and making the 2017 Tax Cuts and Jobs Act (TCJA) provisions permanent, along with advancing incentives to address our nation’s housing supply shortage, are crucial to help achieve these goals.”

The Q2 Sentiment Index topline findings include:

Some sample responses from participants in the Sentiment Index’s Q2 survey include:

“The one thing that every investor – domestic and foreign – wants is stability. The environment in the United States is incredibly unstable, so some of our investors are sitting on the sidelines.”

“Foreign capital flows into the U.S. will shrink in the near term. That said, the U.S. is typically the first market to readjust in terms of pricing, and that will create opportunity.”

“We’re starting to see slightly more trades, which opens up the door to better visibility into valuations, and as a result, may improve the comfort and volume of future trades.”

Data for the Q2 survey was gathered by Chicago-based Ferguson Partners on RER’s behalf in April. See the full Q2 report.

The Real Estate Roundtable brings together leaders of the nation’s top publicly-held and privately-owned real estate ownership, development, lending and management firms with the leaders of major national real estate trade associations to jointly address key national policy issues relating to real estate and the overall economy.

# # #

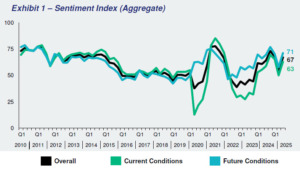

(WASHINGTON, D.C.) — The Real Estate Roundtable’s Q3 2025 Sentiment Index reflects increased confidence among commercial real estate executives as market conditions stabilize and sector-led growth emerges. The Q3 Index posted an overall score of 67, a 13-point increase from the previous quarter, with notable increases in both the Current (63) and Future (71) indices.

RER President and CEO Jeffrey DeBoer said, “Our Q3 Sentiment Index results show that market conditions have continued to stabilize in a meaningful way, supported by improved supply and demand. Commercial real estate executives are increasingly optimistic that the next 12 months will bring continued improvement. That said, certain property types continue to face headwinds, and capital access remains uneven across markets and sectors. Even so, the prevailing sentiment is that stability is returning and opportunities are emerging.”

While challenges remain, industry leaders see meaningful opportunities ahead, particularly in multifamily, data centers, and select office markets.

He added, “The provisions in the One Big Beautiful Bill Act should help accelerate this momentum— expanding housing supply, revitalizing communities, spurring job-creating investment nationwide, and strengthening the broader economy. Coupled with improving debt capital availability and stabilizing asset values, these policies set the stage for renewed growth. Moving forward, industry leaders and policymakers must continue to work together to promote investment, ensure credit access, and address persistent supply-demand imbalances in housing and other high-need property sectors.”

The Q3 Sentiment Index topline findings include:

Survey participants noted that the market is increasingly sector-specific, with performance tied closely to location, asset quality, and loan maturity schedules. Comments highlighted stabilizing fundamentals, renewed deal competition, and a narrowing bid-ask spread in transactions.

Some sample responses from participants in the Sentiment Index’s Q3 survey include:

“The market feels largely stable. There is still uncertainty about what lies ahead, yet conditions are far steadier than we have seen in recent years.”

“Real estate is a local business, and this cycle underlines how unique every market and product type really is. There is no ‘one-size-fits-all’ answer; it all depends on where you are, how favorable your product is, and the date of your loan maturity.”

“Debt is liquid with tight spreads; on the equity side it’s a ‘haves and have-nots’ market. Quality product will still get funded.”

Data for the Q3 survey was gathered by Chicago-based Ferguson Partners on RER’s behalf in July. See the full Q3 report.

The Real Estate Roundtable (RER) brings together leaders of the nation’s top publicly-held and privately-owned real estate ownership, development, lending and management firms with the leaders of major national real estate trade associations to jointly address key national policy issues relating to real estate and the overall economy.

Commercial Real Estate Confidence Holds Steady as Market Stabilizes, Q4 Sentiment Index Shows

(WASHINGTON, D.C.) — The Real Estate Roundtable’s (RER) Q4 2025 Sentiment Index registered an overall score of 67, equivalent to the prior quarter, reflecting that commercial real estate executives’ sentiment has shifted from caution toward guarded optimism as markets stabilize, transaction activity resumes, and expectations build for easing interest rates in 2026.

The Current Index rose one point to 64, while the Future Index dipped slightly to 69, together indicating confidence that the worst disruptions of recent years have passed—even as policy uncertainty and uneven capital access continue to shape near-term decision-making.

Industry leaders credited easing rate pressures and increased market activity for boosting optimism, despite tariffs and shifting policy signals posing persistent challenges.

“Real estate executives see encouraging momentum,” said Jeffrey DeBoer, RER President and CEO. “Roundtable members are reporting steady improvement and renewed confidence across sectors. Despite improvements, tariffs continue to drive up development costs and complicate business planning. Moreover, the record-long government shutdown is disrupting infrastructure and construction permitting, and access to current economic data that companies rely on to plan. Clear, consistent, and coordinated policies from Washington are essential to unlock capital and support long-term economic growth in communities nationwide.”

The Q4 Sentiment Index topline findings include:

Sample responses from participants in the Sentiment Index’s Q4 survey include:

“Market conditions have strengthened, and real estate has benefited from overall market optimism, driven by expectations of continued rate cuts on the short end of the curve and confidence that the economy will avoid a recession.”

“Equity is coming in, but real estate has lots of competition among infrastructure, private markets, etc.”

“Tariffs have been a disaster for our industry, not only because the cost of materials is higher, but also because of the uncertainty they create which significantly hampers the ability to make decisions.”

Data for the Q4 survey was gathered by Chicago-based Ferguson Partners on RER’s behalf in October. See the full Q4 report.

The Real Estate Roundtable (RER) brings together leaders of the nation’s top publicly-held and privately-owned real estate ownership, development, lending and management firms with the leaders of major national real estate trade associations to jointly address key national policy issues relating to real estate and the overall economy.

# # #