Real Estate Roundtable members and policymakers met this week to discuss pressing issues affecting CRE, including return-to-work trends, the looming refinance wave, the debt ceiling, and affordable housing challenges. The Roundtable 2023 Spring Meeting also focused on tax, climate, and regulatory proposals. (The Roundtable’ Policy Priorities and Executive Summary, April 24)

Speakers & Policy Issues

Secretary Raimondo, center, discussed how the Commerce Department is investing billions in federal funds in infrastructure, manufacturing, and other industries to generate jobs and economic growth. The former governor of Rhode Island also focused on her recent “Million Women in Construction Initiative” during a National Public Radio Marketplace interview later the same day.

As a member of the Senate Budget and Foreign Relations Committees, Sen. Kaine offered his insights on negotiations surrounding the debt ceiling, global trade, and efforts to revise federal remote work policies aimed at getting government employees back to their offices. (The Roundtable’s workplace return efforts, Commercial Observer, April 14)

Serving as Vice-Chair of the influential House Financial Services Committee and Chairman of its new Subcommittee on Digital Assets, Financial Technology and Inclusion, Rep. Hill addressed economic issues and CRE, debt ceiling negotiations, the banking system, and monetary policy. Yesterday, the Financial Services Committee approved two bills sponsored by Rep. Hill to expand capital formation.

The government’s fiscal trajectory; the impact of high interest rates on federal revenue and spending; and long-term trends in social security, immigration, and the national debt were among the topics discussed by CBO Director Swagel. (The Fiscal Times, April 25)

A Roundtable member exchange on policy issues included an update on affordable housing challenges facing the industry by NMHC’s President Géno. Capital concerns affecting multifamily and commercial markets were also a topic in a recent Walker Webcast featuring Géno and The Roundtable’s DeBoer, hosted by Roundtable Member Willy Walker (Chairman & CEO, Walker & Dunlop).

Next on The Roundtable's meeting calendar is the all-member Annual Meeting on June 13-14 in Washington, DC.

# # #

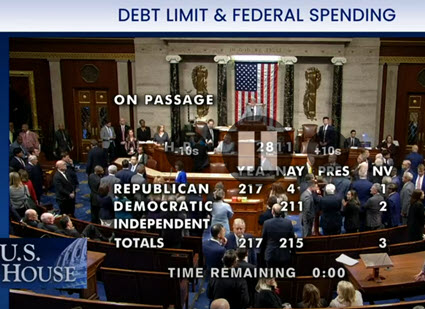

House Republicans this week narrowly passed legislation—the Limit, Save, Grow Act (H.R. 2811)—that would slash government spending and rescind much of the Biden administration’s climate-related incentives in an effort to spur bipartisan talks on raising the nation’s $31.4 trillion debt ceiling. (Roll Call, April 26 and Reuters, April 27)

Avoiding Default

Roundtable Response

The impact of negotiations over federal spending and raising the debt ceiling on the national economy and CRE markets was a focus of discussion during The Roundtable’s Spring Meeting this week (see story above). It is possible that intense discussions among DC policymakers on these issues will be underway during The Roundtable’s all-member meeting on June 13-14 in Washington, DC.

# # #