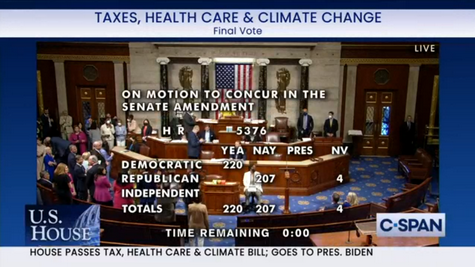

The Inflation Reduction Act of 2022 (IRA) heads to President Joe Biden’s desk for his signature, following passage by the House today and the Senate on Sunday. After weeks of negotiations, the comprehensive economic package primarily brokered by Senate Majority Leader Chuck Schumer (D-NY) and Senator Joe Manchin (D-WV) reflects Democratic priorities to combat climate change, reduce prescription drug costs, and lower the deficit by roughly $300 billion over the next decade. (Washington Post, Aug. 7; Roundtable Weekly, July 29)

Why It Matters

CRE Impact

Real Estate Roundtable President and CEO Jeffrey DeBoer commented today, "The revised Inflation Reduction Act is a welcome step toward boosting economic growth by spurring extensive investments in clean energy and climate measures that benefit both our industry and our country. We applaud Congress for recognizing and protecting the critical role of carried interest provisions in incentivizing the risk-taking necessary for robust economic development. We look forward to working with our partners in industry and government to implement this legislation."

In the coming weeks, The Roundtable will continue updating summaries of the tax and energy provisions in the IRA while also analyzing the direct and indirect impact on commercial real estate. (See below for Clean Energy Tax Incentives Fact Sheet)

# # #

The Inflation Reduction Act (IRA) that passed Congress today (see story above) – “includes the largest expenditures ever made by the federal government to slow global warming.” (New York Times, Aug. 7) The bill “would spend nearly $370 billion on a raft of tax credits to help stimulate adoption of clean energy technologies.” (POLITICO, July 28)

Key CRE Credits and Deductions (RER Fact Sheet)

A number of the IRA’s revisions to the federal tax code can help the U.S. real estate sector reduce GHG emissions. The Real Estate Roundtable has prepared a fact sheet summarizing key IRA incentives, including:

The Senate Finance Committee has provided a summary of all incentives in the IRA’s “Energy Security” Subtitle D.

Roundtable Advocacy

The Internal Revenue Service (IRS) is expected to issue multiple regulations and guidance documents in the coming months that implement the new law. The Roundtable will provide comments as new rules are proposed to help accelerate the CRE industry’s investments in tackling the climate crisis.

# # #

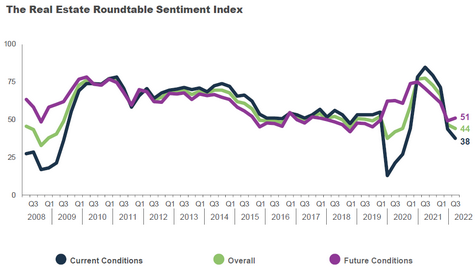

Commercial real estate executives continue to view current conditions as significantly less favorable than previous quarters due to rising interest rates, increased inflation, supply chain disruptions, and labor shortages. However, leaders’ views of where the markets will be one year from today have improved, indicating a cautiously optimistic outlook for the future, according to The Real Estate Roundtable’s Q3 2022 Economic Sentiment Index.

Roundtable President and CEO Jeffrey DeBoer said, “Our Q3 Sentiment Index reflects many of the challenges our economy and industry have faced since early 2022. While these challenges will continue to be bottlenecks in the near term, CRE leaders are optimistic about the future, as underlying real estate fundamentals, such as housing, remain in high demand.

DeBoer added, “Industrial and multifamily continue to be a source of strength, but office and retail still struggle to regain momentum following the pandemic. These are uncertain times, but quality assets and owners will persevere as they continue to meet fundamental demand.”

The Roundtable’s Overall Q3 2022 Sentiment Index—a reflection of the views of real estate industry leaders—registered an overall score of 44. The Economic Sentiment Overall Index is scored on a scale of 1 to 100 by averaging the scores of Current and Future Indices. Any score over 50 is viewed as positive. The Current Index registered at 38, a 19-point decrease compared to Q2 2022; however, the Future Index registered a score of 51, a 5-point increase from the previous quarter, reflecting leaders’ optimism in future conditions.

Topline findings:

Data for the Q3 survey was gathered in July 2022 by Chicago-based Ferguson Partners on The Roundtable’s behalf. Read the full Q3 report.

# # #