Federal Reserve policymakers this week signaled they are likely to raise interest rates next month, after releasing minutes of their most recent Federal Open Market Committee (FOMC) meeting showing growing concerns over the economic repercussions from escalating trade disputes.

|

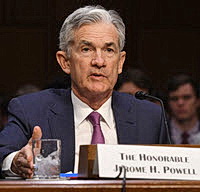

Fed Chairman Jerome Powell today delivered remarks on "Monetary Policy in a Changing Economy" at the Federal Reserve Bank of Kansas City's annual economic symposium . (reference: Powell's speech, Aug. 24) |

|

FOMC minutes show growing concern among monetary policymakers over how trade disputes could pose a threat to economic growth. |

The FOMC's next meeting is scheduled for Sept. 25-26. Former Fed Governor Kevin Warsh (2006 to 2011) will address Roundtable members on Sept. 26 during The Roundtable's Fall Meeting in Washington, DC.

A broad-based business coalition that includes The Real Estate Roundtable urged Treasury Secretary Steven Mnuchin on Wednesday to issue guidance clarifying certain provisions included in tax overhaul legislation enacted last year — including the cost recovery period for qualified improvement property (QIP). ( Coalition letter , Aug. 22)

|

A broad-based business coalition that includes The Real Estate Roundtable urged Treasury Secretary Steven Mnuchin on Wednesday to issue guidance clarifying certain provisions included in tax overhaul legislation enacted last year — including the cost recovery period for qualified improvement property (QIP). (Coalition letter , Aug. 22) |

Roundtable President and CEO Jeffrey DeBoer stated, "In 2015, Congress voted overwhelmingly to permanently extend the 15-year recovery period for certain property improvements. By passing tax reform, Congress intended to consolidate those changes. Treasury should now use its authority to provide taxpayers with relief until a technical corrections bill is enacted. Treasury guidance will remove taxpayer uncertainty, unlock investment, and spur job-creating property upgrades and renovations."