The Real Estate Roundtable (RER) submitted a comment letter this week urging the Treasury Department and IRS to finalize proposed regulations (REG-109742-25) that would repeal the Foreign Investment in Real Property Tax Act (FIRPTA) “look-through” rule for domestically controlled real estate investment trusts (REITs). (Letter, Dec. 5)

RER Advocacy

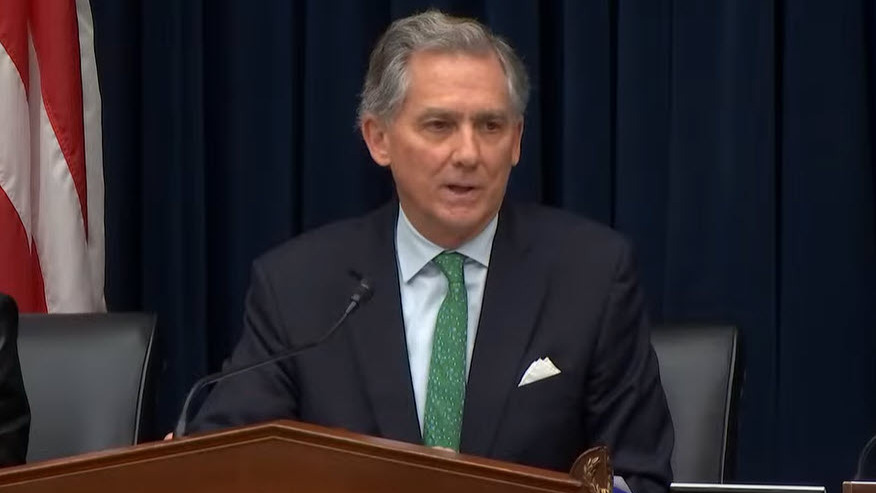

House Ways & Means Hearing – International Tax

RER and other industry groups have warned that reviving Section 899 could negatively impact U.S. commercial real estate by deterring foreign investment, weakening capital formation, increasing borrowing costs, and dampening property values.

The House Financial Services Committee held an oversight hearing this week on prudential regulators, as federal agencies continue to reassess large bank capital standards. Ahead of the hearing, The Real Estate Roundtable (RER) and a coalition of business organizations urged regulators to modernize capital requirements to support lending, investment, and U.S. competitiveness.

House Financial Services Committee Hearing

Roundtable Advocacy

Enhanced Supplementary Leverage Ratio (eSLR)

As regulators continue work on a revised Basel III Endgame proposal, RER will remain engaged to ensure capital reforms protect safety and soundness without constraining credit flows essential to commercial real estate, economic activity, and long-term investment.

House lawmakers are set to vote before year’s end on a number of housing, energy, and permitting reform bills, with the bipartisan SPEED Act at the center of a broader push to address grid reliability and energy affordability.

SPEED Act

Industry Support

Senate Energy Plan

House Committee Advances Energy Affordability Measures

Up Next: GHG Protocol - Scope 2 Guidance

RER will continue working with lawmakers and industry partners to advance permitting reforms that expand energy supply, strengthen grid reliability, and support real estate investment across property types.

Housing Hearing

State of Play

Senate Housing Legislation

EB-5 & Workforce

RER will continue engaging with policymakers and industry leaders to promote bipartisan solutions and regulatory reforms that expand housing supply, improve affordability, and strengthen economic stability.