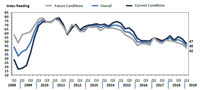

The Real Estate Roundtable's 2019 Q1 Sentiment Index released today reveals confidence from commercial real estate industry executives that today's fundamentally sound CRE markets will prove resilient when the decade-long expansion of the U.S. economy inevitably slows down.

|

The Real Estate Roundtable's 2019 Q1 Sentiment Index released today reveals confidence from commercial real estate industry executives that today's fundamentally sound CRE markets will prove resilient when the decade-long expansion of the U.S. economy inevitably slows down. |

DeBoer noted, "Over the last decade, the commercial real estate industry has not overbuilt or over-leveraged, resulting in disciplined markets that could act as a resilient buffer to any potential slowdown in the U.S. economy. Our Q1 survey shows industry executives have concerns over unpredictable influences on the economy, such as the recent government shutdown and uncertain outcome of ongoing international trade talks. Policymakers need to focus on bipartisan pro-growth policies designed to encourage further investment, spur job creation and propel the economy forward for all."

Economic Slowdown Forecasts

St. Louis Fed President James Bullard told CNBC yesterday he expects the economy to slow to a 2.25% annual rate this year from 3% in 2018. Bullard is a voting member of the Federal Reserve's Federal Open Market Committee, which meets regularly to set the direction of U.S. monetary policy and interest rates.

|

St. Louis Fed President James Bullard told CNBC yesterday he expects the economy to slow to a 2.25% annual rate this year from 3% in 2018. |

Dr. Ken Rosen (Chairman, Rosen Consulting Group) led a discussion during The Roundtable's Jan. 29 State of the Industry Meeting about recent Fed actions, stock market volatility and how signs of weakness in the Chinese economy may affect future U.S. growth. (Roundtable Weekly, Feb. 1)

Vice President Mike Pence and Sen. Tim Scott (R-SC) promoted the new Opportunity Zones (OZ) program in South Carolina yesterday as an example of how economically distressed areas can be redeveloped to benefit lower-income communities. (WCBD video, Feb. 21)

|

Vice President Mike Pence and Sen. Tim Scott (R-SC), above, promoted the new Opportunity Zones (OZ) program in South Carolina yesterday as an example of how economically distressed areas can be redeveloped to benefit lower-income communities. (WCBD video, Feb. 21). |

A recent IRS hearing focused on how OZ regulatory guidance may affect long-term investments in certain low-income communities. The Treasury Department is expected to release its second set of OZ regulations in the coming weeks. Another public hearing will follow before rules for the program are finalized. (Roundtable Weekly, Feb. 15)