Vice President Kamala Harris broke a 50-50 tie in the Senate on Feb. 5 to pass a budget resolution that will allow President Biden’s proposed $1.9 trillion pandemic relief package to advance without GOP support. (New York Times, Feb. 5)

Changes Possible Before Final Package

Separately, a power-sharing agreement for the 50-50 Senate was unanimously adopted on Feb. 3 by the chamber after Majority Leader Schumer and Minority Leader Mitch McConnell (R-KY) finalized terms. The agreement allows Democrats to take control of Senate committees and formalize their leadership. (Wall Street Journal and Politico, Feb. 3)

# # #

The Real Estate Roundtable is a Founding Partner of a national program unveiled Feb. 3 by the Real Estate Executive Council (REEC) – the trade association for CRE professionals of color – that will seek to address equity, diversity, and inclusivity issues across the commercial real estate industry with a wide spectrum of partner companies and organizations. (REEC news release, Feb. 3)

The Real Estate Roundtable is a Founding Partner of a national program unveiled Feb. 3 by the Real Estate Executive Council (REEC) – the trade association for CRE professionals of color – that will seek to address equity, diversity, and inclusivity issues across the commercial real estate industry with a wide spectrum of partner companies and organizations. (REEC news release, Feb. 3)

# # #

Bipartisan legislation introduced Feb. 4 by House Ways and Means Members Brad Schneider (D-IL) and Darin Lahood (R- IL) would modernize real estate investment trust (REIT) tax provisions to permit REITs to invest equity in struggling commercial tenants that have been harmed by the COVID-19 pandemic. (News release, Feb. 4)

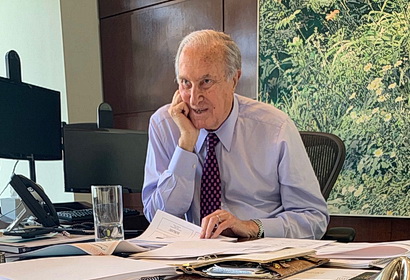

Speaking at a virtual event with the sponsors and stakeholders on the day of introduction, Roundtable President and CEO Jeffrey DeBoer said, “[A]s important and helpful as Congress’s actions have been for smaller businesses, a lifeline is now needed, particularly to larger retail businesses and the people who work in the retail industry.”

“The legislation is not a tax cut or a tax break,” DeBoer continued, “It is very much a private sector solution. It would provide a legal framework for property owners ... to put their own capital at risk by making equity investments in struggling retail businesses that employ tens of thousands of workers nationwide.”

# # #

Benjamin V. Lambert – an industry icon who served as Chairman of Eastdil Secured and as former Chair of The National Realty Committee (predecessor of The Real Estate Roundtable) – passed away the weekend of Jan. 30. (Commercial Observer, Feb. 2 and TheRealDeal, Feb. 1)

Among his many affiliations beyond Eastdil, he served on the board of trustees for Brown University and the Silver Shield Foundation and was a Founder and Chairman of the Harlem Day Charter School.

# # #