Congressional negotiators reported progress on a border-security deal this week, as they aim to pass legislation by Feb. 15 to fund approximately 25% of the government. Without a new funding measure, the government will face a second partial shutdown. (Roundtable Weekly, Feb. 1)

|

Senate Appropriations Chairman Richard Shelby (R-AL) met with President Trump yesterday, stating: "[The president] said to me again he would like for us to wrap it up, to get a legislative solution. We're negotiating on the substance, serious stuff now..." |

Infrastructure

President Trump also briefly commented during the SOTU on the need for funding national infrastructure improvement projects. "I know that Congress is eager to pass an infrastructure bill. And I am eager to work with you on legislation to deliver new and important infrastructure investment, including investments in the cutting edge industries of the future. This is not an option, this is a necessity," Trump said. (Politico, Feb. 5)

|

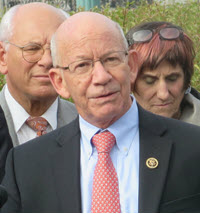

House Transportation and Infrastructure Committee Chairman Peter DeFazio (D-OR) on "The Cost of Doing Nothing: Why Investing in Our Nation's Infrastructure Cannot Wait." |

The Roundtable sent a comment letter to President Trump in Jan. 2018 offering specific suggestions on how innovative financing sources may be used to help pay-for infrastructure improvements – and how restructuring a lengthy permitting process and cutting unnecessary red tape will help control project costs and delays. (Reference: The Roundtable's 2019 Policy Agenda Infrastructure section).

"Green New Deal"

This week also saw the unveiling of a sweeping Democratic congressional resolution called the "Green New Deal" that aims to "achieve net-zero greenhouse gas emissions" in the next 10 years. (Sen. Ed Markey new release, Feb. 7)

|

Rep. Alexandria Ocasio-Cortez (D-NY) and Sen. Ed Markey (D-MA) introduced a sweeping Democratic congressional resolution called the " Green New Deal " that aims to "achieve net-zero greenhouse gas emissions" in the next 10 years. |

Energy efficiency for commercial buildings, government funding and infrastructure and were among the topics discussed last week during The Roundtable's State of the Industry Meeting, where Speaker of the House Nancy Pelosi (D-CA) was a featured speaker. (Roundtable Weekly, Feb. 1)

Senate Banking Committee Chairman Mike Crapo (R-ID) on Feb. 1 released an outline for reforming the nation's housing finance system, including the Government Sponsored Enterprises (GSEs) Fannie Mae and Freddie Mac. (Crapo Statement and Housing Reform Outline, Feb. 1)

|

Senate Banking Committee Chairman Mike Crapo (R-ID) on Feb. 1 released an outline for reforming the nation's housing finance system, including the Government Sponsored Enterprises (GSEs) Fannie Mae and Freddie Mac. |

|

"Housing finance reform must appropriately balance taxpayer protections with the need to establish an efficient marketplace that can provide strong and sustained mortgage liquidity in single family and multifamily markets – as well as affordable housing," said Roundtable President and CEO Jeffrey DeBoer. |

House Financial Services Committee Chairwoman Maxine Waters (D-CA) is expected to oppose measures that seek to limit the government's role in the mortgage market.

Industry Developing Principles for Reform

The Real Estate Roundtable continues to work as part of an industry coalition to develop certain principles that would form the foundation of GSE reform legislation

"Reform should encourage the transfer of appropriate credit risk to the private sector, while building on the highly effective risk sharing mechanisms utilized in Fannie Mae's existing Delegated Underwriter Servicing (DUS) program and Freddie Mac's K Deals," DeBoer added.