Banks are increasing their efforts to modify troubled commercial real estate loans to prevent defaults, according to recent media reports. (GlobeSt and Bisnow, July 14)

Momentum on Modifications

Banks are increasing their efforts to modify troubled commercial real estate loans to prevent defaults, according to recent media reports. (GlobeSt and Bisnow, July 14)

Momentum on Modifications

Overall workplace occupancy registered 49.1% last week, according to Kastle’s 10-city Back to Work Barometer, which showed return to office rates vary significantly over the course of the week. Additionally, a recent Department of Labor American Time Use Survey showed that nearly 35% of Americans worked from home on an average day in 2022, down from nearly 40% in 2021. (Axios, June 23)

Public Sector

Roundtable Response

A study released in May by New York University and Columbia University researchers shows how the disruption from remote work could impact municipalities. “The fiscal hole left by declining office and retail property tax revenues would need to be plugged by raising tax rates or cutting government spending. Both would affect the attractiveness of the city as a place of residence and work.” (Work From Home and the Office Real Estate Apocalypse, May 15 and Roundtable Weekly, May 26)

# # #

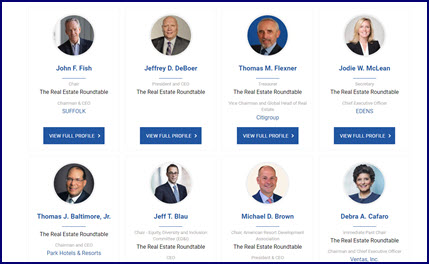

The Real Estate Roundtable’s membership has approved five new members to serve on its 25-member Board of Directors during the 2024 fiscal year (July 1, 2023 – June 30, 2024). The Roundtable’s Board is effective July 1, elected from the membership, and includes industry representatives from four of The Roundtable’s 18 national real estate trade partners.

Board Transition

The five new members joining The Roundtable’s FY 2024 Board of Directors as of July 1 are:

Stepping down from The Roundtable Board as of July 1 are:

The Roundtable’s 2023 Annual Report—“Sustained Strength, Sustained Solutions”—will be sent to all members next week.

# # #