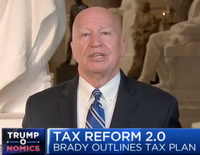

House Ways and Means Committee Chairman Kevin Brady (R-TX) on July 24 outlined a proposed second round of tax cuts to House Republicans, who hope to vote on “Tax Reform 2.0” before the midterm elections..

|

In an interview with CNBC, Brady expanded on the three core components of the Tax Reform 2.0 proposal. |

Senior Ways and Means Committee Member Devin Nunes (R-CA) has introduced legislation (H.R. 6444) to index capital gains to inflation – a proposal that would reduce the tax burden on long-lived assets, including real estate. |

In January, The Roundtable wrote to Treasury Secretary Mnuchin offering several suggestions designed to maximize the economic impact of the pass-through deduction and avoid unnecessary disruptions to business activity. [Roundtable Letter, Jan. 18].

Rep. Bill Shuster (R-PA), the outgoing chairman of the House Transportation and Infrastructure Committee, released "discussion draft" language on July 23 aimed at improving and sustainably financing U.S. transportation and other infrastructure systems. (Section-by-Section analysis of the proposal)

|

Roundtable President and CEO Jeffrey D. DeBoer appeared last summer on CNBC’s Squawk Box, emphasizing the importance of P3s as a platform to finance the design, building, operation and long-term maintenance of projects across all infrastructure asset classes(CNBC, June 7, 2017). |

Roundtable President and CEO Jeffrey D. DeBoer appeared last summer on CNBC's Squawk Box, emphasizing the importance of P3s as a platform to finance the design, building, operation and long-term maintenance of projects across all infrastructure asset classes. Policies starting with streamlined permitting and a range of financing platforms should all be considered by lawmakers as layers in the "capital stack" for infrastructure," DeBoer told Squawk Box. (CNBC, June 7, 2017)

In a bipartisan effort to spur tourism to the U.S., create jobs, reform outdated visa laws and increase national security, Reps. Mike Quigley (D-IL) and Tom Rice (R-SC) yesterday introduced the Jobs Originating through Launching Travel (JOLT) Act of 2018.

|

"By improving the visa process, strengthening national security, and welcoming vetted travelers, the U.S. will be able to realize economic benefits at hotels, restaurants, retail store, and attractions around the country," said VisitU.S. Coalition spokesman Amos Snead. (VisitU.S. News Release, July 26) |

A panel discussion at The Roundtable's June 14 Annual Meeting focused on travel and tourism, economic growth and CRE. Participants included Roger Dow, President and CEO, U.S. Travel Association; Katherine Lugar, President and CEO, American Hotel & Lodging Association; Senator Amy Klobuchar (D-MN) and Anthony E. Malkin (Chairman and CEO, Empire State Realty Trust). (Roundtable Weekly, June 15, 2018.)