As landmark tax reform enacted last December begins to reverberate through the economy, economists, Congress and industry experts are starting to assess its impact on economic investment and commercial real estate.

|

The House Ways and Means Committee plans to hold a series of hearings on the Tax Cuts and Jobs Act (TCJA) impact on job creation and the economy starting May 16. |

TCJA & Economic Investment:

New data shows tax reform is resulting in more capital investment and expenditures.

|

Cycle Watch: |

TCJA's Positive Impact on Commercial Real Estate:

|

The Impact of Tax Reform by Peter Linneman, Commercial Property Executive (May 2) – "… Tax reform legislation is neutral to positive for commercial real estate and very positive for the economy in general. Because the changes to commercial real estate are not dramatic, most investors should feel fairly confident." |

Along with TCJA rulemaking and implementation, the legislation's impact on CRE will be a focus of discussion at The Roundtable's Annual Business Meeting and Policy Advisory Committee Meetings on June 14-15 in Washington, DC

House Majority Leader Kevin McCarthy (R-CA) yesterday said the House will vote on the Senate's Dodd-Frank reform bill (S. 2155), before Memorial Day. S. 2155 includes a measure to reform the Basel III High Volatility Commercial Real Estate (HVCRE) Rule – a top Roundtable priority. (Roundtable Weekly, May 4)

|

House Majority Leader Kevin McCarthy (R-CA) said the House will vote on the Senate's Dodd-Frank reform bill ( S. 2155 ), before Memorial Day. |

|

The Roundtable and 12 other real estate organizations on March 2, 2018 sent a comment letter urging all members of the Senate Banking Committee to enact the HVCRE measure by including the measure in the broader Dodd-Frank reform package (S. 2155). |

HVCRE Reform Measure Included

Since 2015, The Roundtable's HVCRE Working Group and industry coalition partners have played a key role in advancing specific reforms to the HVCRE Rule. During next month's Real Estate Roundtable Annual Meeting, HVCRE will be a focus of discussion, with more specific details offered during the Real Estate Capital Policy Advisory Committee (RECPAC) meeting on June 14.

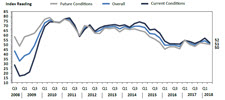

The Roundtable's Q2 2018 Economic Sentiment Index released yesterday shows that as plentiful financing and equity continue to drive commercial real estate investment activity, industry leaders continue to see balanced market fundamentals, despite rising costs of construction and an uncertain outlook for markets in 2019.

|

The Roundtable's Q2 2018 Economic Sentiment Index shows plentiful financing and equity continue to drive commercial real estate investment activity. |

The report's Topline Findings include:

|

Roundtable President and CEO Jeffrey DeBoer, "As our Q2 Index show, with debt and equity readily available for quality investments and new development opportunities, industry leaders are being forced to reevaluate, innovate, and reimagine their buildings – driven by an influx of the millennial generation and their new set of expectations for office and multifamily markets." |

"Real estate fundamentals continue to remain strong into 2018, where balance between supply and demand in almost every sector is healthy, while debt and equity for real estate as an asset class remains abundant," said Roundtable President and CEO Jeffrey DeBoer. "There are fears about political uncertainty, trade wars and interest rate increases, which are having some impact and creating a manageable amount of uncertainty for the markets for the remainder of 2018 and looking ahead to 2019."

DeBoer added, "As our Q2 Index shows, with debt and equity readily available for quality investments and new development opportunities, industry leaders are being forced to reevaluate, innovate, and reimagine their buildings – driven by an influx of the millennial generation and their new set of expectations for office and multifamily markets. It is vital for our industry to continue developing new technology solutions for the ever evolving demands of the market."

Data for the Q2 survey was gathered in April by Chicago-based FPL Associates on The Roundtable's behalf. The next Sentiment Survey covering Q3 2018 will be released in August.