Roundtable Leaders Emphasize Need for Regulators to Allow More Flexibility for Restructuring CRE Loans

This week, Real Estate Roundtable leaders emphasized the need for federal regulators to allow more flexibility for lenders and borrowers to restructure commercial real estate loans facing potential default—as the Federal Reserve reported that CRE poses a potential risk to financial stability. (Fed’s Financial Stability Report, May 2023)

Request for Time

- Real Estate Roundtable Chair John Fish, above, (Chairman and CEO, SUFFOLK) summarized the industry’s views in a May 9 MarketWatch article, noting that the Fed and regulatory agencies should grant more flexibility for borrowers, including corporate real estate developers, to restructure CRE loans.

- Fish explained how an impending wave of $1.5 trillion in CRE loans—combined with tight lending conditions and higher, unsustainable interest rates—could stifle construction and development in major cities struggling to bounce back from the pandemic. (MarketWatch article pdf)

- Post-pandemic CRE values have dropped $453 billion, according to the U.S. National Bureau of Economic Research, especially in cities with high vacancy rates due to ongoing work-from-home policies. Prior to the pandemic, 95% of U.S. offices were occupied. Today, that number is closer to 47%. Collapsing property values are threatening the fiscal health of cities across the nation. (GlobeSt, March 3)

- Defaults on CRE loans hit a 14-year high in February. Fish emphasized that further economic damage can be avoided if federal regulators grant additional time for markets to stabilize, as they have done in the past. (See regulatory notices from 2009, 2020, and 2022)

- Real Estate Roundtable Chairman Emeritus Bill Rudin, above left, (Co-Chairman and CEO, Rudin Management Co.) discussed similar topics today on CNBC’s Squawk on the Street.

- “We are going to have to figure out a plan with the federal government to allow banks to have some time to work through some of these loans. It has been done before, so you can restructure, and get more equity into the deal, so that we don’t see this cascade of defaults that we’ve already started seeing happening. There has to be some thought to give banks, owners, and developers time to restructure loans,” Rudin said.

Fed Reports

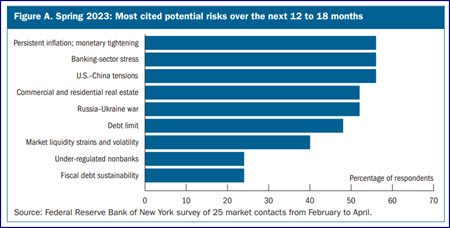

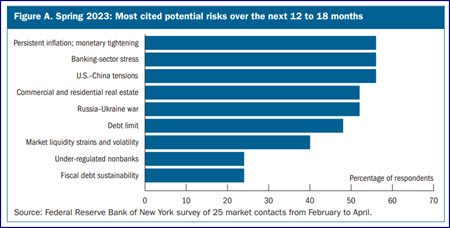

- A pair of recent Federal Reserve surveys show the state of CRE conditions and the potential risks the sector poses to the financial system. (Enlarged graphic, above | Axios, May 9 and New York Times, May 8)

- On Monday, the Fed released its bi-annual Financial Stability Report—a survey of market experts, economists, and academics that assesses concerns about the nation's financial and economic health. The report, which includes a special section on commercial real estate-related risks, identifies CRE as the fourth-largest financial stability concern. (Commercial Observer, May 10 and ConnectCRE, May11)

- Many survey respondents noted CRE as a "possible trigger for systemic risk," listing concerns about higher interest rates, valuations, and shifts in end-user demand. "With CRE valuations remaining elevated … the magnitude of a correction in property values could be sizable and therefore could lead to credit losses by holders of CRE debt," according to the May report. (GlobeSt, May 10)

- Additionally, the Fed’s April 2023 Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS) addressed changes in the demand, standards and terms for bank loans over the past three months. The survey notes, "Banks reported having tightened all the terms surveyed on all categories of CRE loans."

- Over the first quarter of this year, the SLOOS shows a majority of banks reported concerns about an uncertain economic outlook, reduced tolerance for risk, worsening of industry-specific problems, and deterioration in their current or expected liquidity position. Mid-sized banks generally reported tightening both price and non-price terms more frequently than the largest banks and other banks, according to the loan officer survey.

The Roundtable continues to urge federal regulators to issue guidance that would give financial institutions increased flexibility to refinance loans with borrowers and lenders. The various market pressures facing CRE will be discussed during The Roundtable’s all-member Annual Meeting on June 13-14 in Washington.

# # #