The Biden Administration today issued its FY22 budget proposal, which serves as a benchmark of its tax policy priorities, accompanied by the Treasury Department’s “General Explanations of the Administration’s Revenue Proposals.” Meanwhile, negotiations continued this week between Senate Republicans and the White House on the scope and cost of President Biden’s multitrillion infrastructure investment proposal.

Budget Pay-fors

GOP Infrastructure Counteroffer

According to Axios, Senate Democrats intend to continue working on bipartisan infrastructure negotiations through the week after Memorial Day congressional recess “… then forge ahead on their own if there's no deal.” (Axios, May 24)

# # #

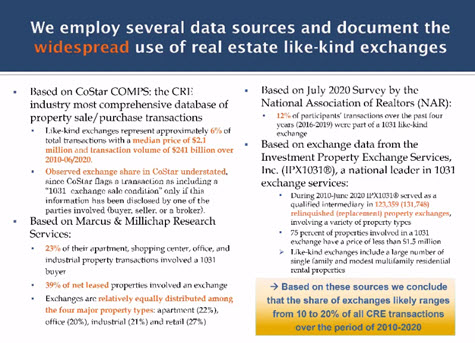

A broad business coalition that includes The Real Estate Roundtable held a virtual briefing this week on the economic importance of like-kind exchanges (LKEs) for members of Congress and their staff. Additionally, several Roundtable members focused on the future of urban areas and economic growth during a “Stand With Cities” webcast.

LKE Examples & Data

Stand With Cities

Like-Kind exchanges and economic growth proposals under consideration by Washington policymakers will be a focus of discussion during The Roundtable’s June 15-16 Annual Business Meeting and Policy Advisory Committees Meetings (all remote).

# # #

The Senate Finance Committee on Wednesday advanced an improved energy efficiency tax deduction for commercial buildings (Section 179D) that would make the incentive more usable for “retrofits” of older buildings, multifamily structures, and REITs. (Clean Energy for America Act (S. 1298), mark-up video and supporting documents)

Section 179D & CRE

Roundtable Recommendations

Davis-Bacon Prevailing Wage Concerns

Energy and tax policies affecting commercial real estate will be a focus of discussions during The Roundtable’s June 15 all-member Annual Meeting – and during its June 16 Tax Policy Advisory Committee (TPAC) and Sustainability Policy Advisory Committee (SPAC) Meetings.

# # #

The Real Estate Roundtable has released its FY2018 Annual Report “Building Success,” which reports on the organization’s policy activities from July 1, 2017 to June 30, 2018 and outlines its policy priorities for the coming year.

The Report includes summaries showing continued progress on the policy front, including:

Newly elected Roundtable Chair Debra A. Cafaro (Chairman and Chief Executive Officer, Ventas, Inc.) emphasized that The Roundtable’s policy agenda remains full of key issues that require our engagement as a non-partisan industry voice. “Above all, we must uphold our independent and respected position on Capitol Hill, emphasizing our optimism about the economy and the positive contributions the real estate industry provides as a job creator and as a cornerstone for retirement savings. We are committed to proactively advancing policies that promote a healthy balance of capital and people flows to create sustainable economic growth that is good for our members, our industry and our national economy,” said Cafaro.

The publication includes a listing of all Roundtable members, as well as the FY2019 Board of Directors and Committee Leadership, and has been mailed to all Roundtable members, congressional offices on Capitol Hill, and is available online.