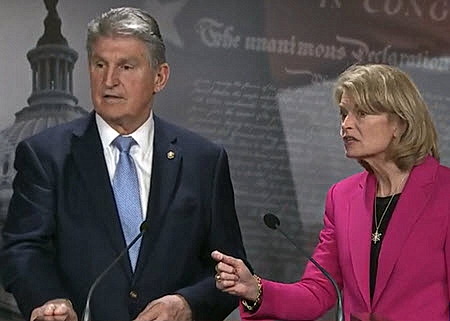

Senators Joe Manchin (D-WV), left, and Lisa Murkowski (R-AK), right, have led bipartisan meetings with lawmakers over the last two weeks to explore potential areas of agreement for a scaled-back energy and climate legislative package before the midterm elections. (Politico Morning Energy and E&E News, May 5 | The Hill, April 25)

BBB Energy Measures

Search for Agreement

Sen. Chris Van Hollen (D-MD) recently stated, “I think it’s a make-or-break moment for the elements of Build Back Better that are still on the table. The clock is ticking. This is a perishable moment.” (Wall Street Journal, April 28)

# # #

A bipartisan push in the Senate is underway to pass a bill that would allow federally regulated banks to provide mortgage and financial services to state-licensed, cannabis-related businesses (CRBs)—without the threat of federal penalties. (The Hill, May 4)

SAFE & COMPETES

Next: Senate-House Conference

An Unbanked Industry

A Senate bill seeking wider cannabis reforms is supported by Senate Majority Leader Chuck Schumer (D-NY), Senate Finance Committee Chair Ron Wyden (D-OR) and Sen. Cory Booker (D-NJ). The Democratic leaders originally planned to introduce their bill this month, but recently announced it will be delayed until August. (PoliticoPro, April 14)

# # #

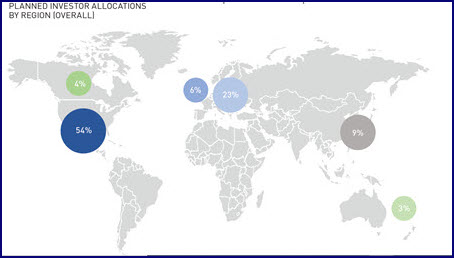

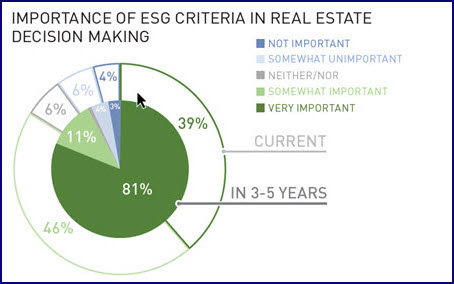

Global investors plan to increase net investment this year in US commercial real estate, with a focus on multifamily, life science and industrial assets, according to the Association for International Real Estate Investors’ (AFIRE) 2022 Annual International Investor Survey Report.

Positive Outlook

Market Sectors & ESG Influence

The annual survey responses were collected in February from the AFIRE membership—which represents nearly 175 organizations from 23 countries, with approximately US$3 trillion assets under management—and the global institutional investor community.

# # #