On Tuesday, the Treasury Department released proposed regulations governing the new limitation on the deductibility of business interest expense, including the exception for real estate businesses.

|

On Tuesday, the Treasury Department released proposed regulations governing the new limitation on the deductibility of business interest expense, including the exception for real estate businesses. |

|

Business interest deductibility was a key issue in Real Estate Roundtable President & CEO Jeffrey DeBoer's testimony before the Senate Finance Committee shortly before consideration of the tax bill. (Roundtable Statement for the Record, Sept. 19, 2017 and video clips ). |

The Roundtable's Tax Policy Advisory Committee is continuing to review the 439-page regulatory package to understand its full implications for the financing of U.S. real estate. Comments on the proposed regulations will be due 60 days after their publication in the Federal Register.

Following the Nov. 6 mid-term elections, a “Lame Duck” session of Congress is expected to consider various tax policies of importance to commercial real estate.

|

Several tax issues of importance to real estate may be in play during the November "Lame Duck" congressional session, including condo tax accounting rules; technical corrections; the cost recovery period for qualified improvement property (QIP);and tax extenders. |

Last week, an article on the condo tax accounting issue in The Real Deal included a quote from Roundtable Senior Vice President & Counsel Ryan McCormick, who commented on the outlook for correcting the current rules. "Legislation may be the most likely route, in light of all the work ongoing at Treasury with tax reform," McCormick said.

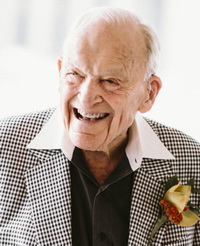

The commercial real estate industry mourns the recent passing of real estate industry icon Marshall Bennett. He was 97. (Chicago Tribune, Oct. 16)

|

Commercial real estate industry icon Marshall Bennett passed away this week at the age of 97. |

Notably, Bennett co-founded Roosevelt University’s Marshall Bennett Institute of Real Estate in 2002. He helped raise $11 million to start the school as a training ground for real estate professionals. Since its inception, the program has graduated almost 325 in two master’s degree programs. (Crain’s Chicago Business, Oct. 15)