The Treasury Department and the Internal Revenue Service (IRS) on Monday released a new Notice of Proposed Rulemaking that would repeal the FIRPTA “look-through” rule for domestically controlled real estate investment trusts (REITs)—a significant policy shift strongly supported by The Real Estate Roundtable (RER).

Proposed Change

RER Advocacy

Treasury Acknowledges Industry Concerns

Roundtable on the Road

RER will continue to engage with Treasury on areas where further guidance or regulatory changes are needed.

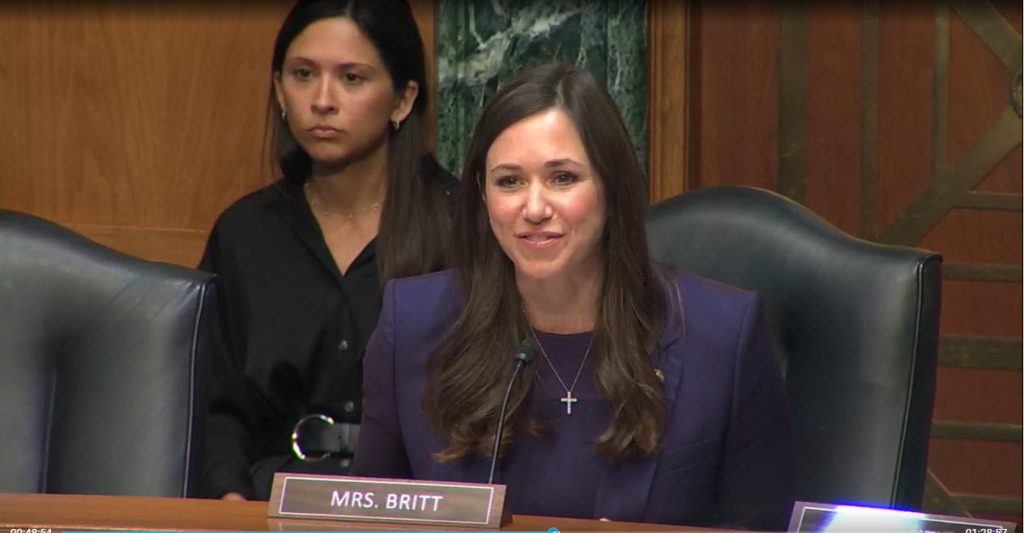

The Senate Banking Subcommittee on Housing, Transportation, and Community Development held a hearing this week, “Innovation in U.S. Housing: Solutions and Policies for America’s Future,” which examined the nation’s housing shortage, the impact of rising regulatory costs, and innovative approaches such as modular and off-site construction, accessory dwelling units (ADUs), and pre-disaster mitigation to help address the housing crisis.

Hearing Highlights

By the Numbers

RER Advocacy

Roundtable on the Road – Chicago

Housing, GSE reform, and solutions to improve housing affordability will be key topics of discussion during RER’s Fall Roundtable Meeting next week in Washington, D.C., on Oct. 27-28 (Roundtable-level members only).

The federal government shutdown—now in its fourth week and the second-longest in U.S. history—shows no sign of ending as partisan divisions deepen and the House remains in recess. (Punchbowl News, Oct. 24)

State of Play

Economic and Operational Strains

Looking Ahead & What’s at Stake

Path Forward

RER continues to urge Congress to act responsibly to reopen the government and restore critical housing, insurance, and economic programs essential to real estate investment and growth.