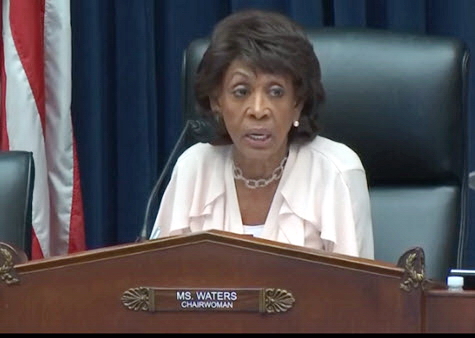

House Financial Services Committee Chairwoman Maxine Waters (D-CA), above, yesterday announced an Oct. 16 subcommittee hearing that will focus on “Protecting America: The Reauthorization of the Terrorism Risk Insurance Program.” (Committee news release, Oct. 3)

During an October 1 podcast episode of “Through The Noise,” Roundtable President and CEO Jeffrey DeBoer noted, “Businesses and facilities of all types need to see the terrorism risk insurance program extended. This need applies to hospitals, all commercial real estate buildings, educational facilities, sports facilities, NASCAR and theme parks, and really any place where commercial facilities host large numbers of people.”

# # #

The Trump Administration took a key step on Sept. 30 to release Fannie Mae and Freddie Mac from conservatorship by allowing them to retain a total of $45 billion in earnings annually. (Wall Street Journal, Sept. 30)

The Real Estate Roundtable and 27 industry organizations on March 1 submitted principles for reforming the GSEs. The letter emphasized that compelling evidence must show the private market is capable of an expanded role before efforts are made to reduce the GSEs' current housing finance footprint. "Ultimately, we believe any reform, be it administrative or legislative, must seek to further two key objectives: 1) preserving what works in the current system, while 2) maintaining stability by avoiding unintended adverse consequences for borrowers, lenders, investors, or taxpayers." (Roundtable Weekly, March 1)

# # #

The Real Estate Roundtable and more than 150 national trade associations urged Congress this week to reauthorize the Highway Trust Fund – the nation’s primary source for road and mass transit funds – ahead of its September 30, 2020 expiration. (Coalition letter, Sept. 30)

The Roundtable continues to provide infrastructure policy recommendations to Congress. (Roundtable Weekly, May 3, 2019, and March 22, 2019). Additionally, Roundtable President and CEO Jeffrey D. DeBoer discussed the role of public-private partnerships in modernizing the nation’s infrastructure on CNBC's Squawk Box in June 2017.

# # #

The publication Emerging Trends in Real Estate 2020, released by the Urban Land Institute (ULI) and PwC, reports that U.S. real estate remains a favored asset class, as economic uncertainty and societal changes have resulted in successful industry adaptations to space design, development and business operations.

Public policies affecting CRE will be discussed during The Roundtable’s Fall Meeting on Oct. 30 in Washington, where guests will include U.S. Housing and Urban Development (HUD) Secretary Ben Carson.

# # #