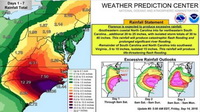

As Hurricane Florence made landfall this morning near Wrightsville Beach, NC, the storm’s large size and slow speed are expected to produce severe flooding, affecting millions of individuals who have evacuated affected coastal areas and thousands of businesses in the Carolinas. (National Hurricane Center, Hurricane Florence)

|

As communities in the Carolinas and beyond contend with catastrophic storm surge, rain deluge, high winds and loss of property, Real Estate Roundtable President and CEO Jeffrey DeBoer expressed concern about the disaster and its victims, encouraging those in the industry to participate in relief efforts. |

|

President Trump announced more than 3,800 Federal Employees, including more than 1,000 from the Federal Emergency Management Agency (FEMA), are working with State and local partners to respond to Hurricane Florence. (White House Statement, Sept. 14) |

The Roundtable will continue to work closely with lawmakers and our coalition partners to ensure that the NFIP is renewed prior to its expiration date on Nov. 30, 2018.

Last month the Environmental Protection Agency (EPA) announced the first updates to its ENERGY STAR scoring models in over a decade, as the agency moved from 2003 to 2012 data for its foundation to rate buildings. (See Roundtable Weekly, Aug. 17.) EPA announced yesterday that it will commence a "review period" to solicit stakeholder feedback on these recent ENERGY STAR score updates. Certifications for office, industrial, and certain other building categories will be temporarily suspended during this review period.

|

EPA announced yesterday that it will commence a "review period" to solicit stakeholder feedback on recent ENERGY STAR score updates. Certifications for office, industrial, and certain other building categories will be temporarily suspended during this review period. |

The review period and temporary suspension of ENERGY STAR building certifications do not apply to multifamily, data center, hospital, senior care communities, and manufacturing facilities, according to EPA.

The House Ways and Means Committee yesterday passed “Tax Reform 2.0” legislation along party lines (21-15) that would make permanent individual and pass-through business tax cuts set to expire at the end of 2025. House leaders plan a full chamber vote by the end of this month to highlight the GOP’s signature economic policy achievement before the November mid-term elections. (House Ways and Means Committee Mark-up Resourcesand Reuters, Sept. 13)

|

House Ways and Means Chairman Kevin Brady (R-TX) during the "Tax Reform 2.0" mark-up on Sept. 13. |

The House will be out of session until Sept. 25, which gives Congress four days to pass government funding by Oct. 1 to avoid a shutdown. Yesterday, House Appropriations Chairman Rodney Frelinghuysen (R-NJ) announced at a meeting of House and Senate conferees that a deal has been reached on a continuing resolution to keep all of the government funded through at least Dec. 7.