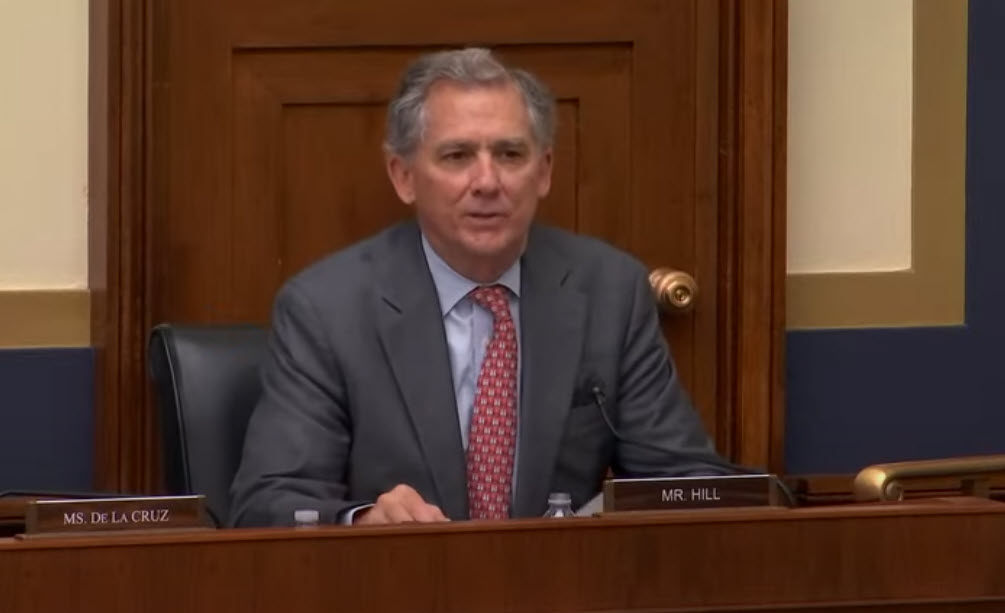

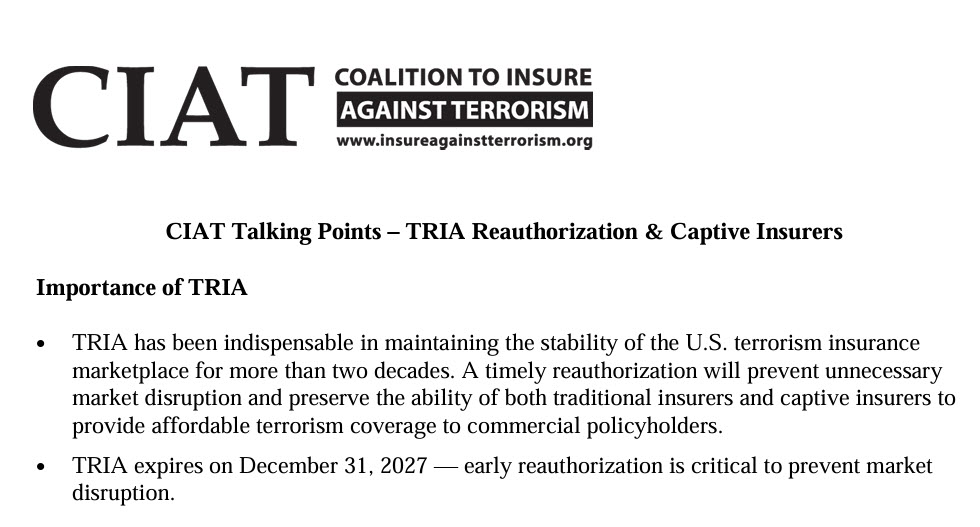

The Coalition to Insure Against Terrorism (CIAT) submitted a letter this week to the House Financial Services Housing and Insurance Subcommittee ahead of its Sept. 17 hearing on “The Reauthorization of the Terrorism Risk Insurance Act of 2002 (TRIA).” The letter urged lawmakers to act well in advance of TRIA’s scheduled expiration on Dec. 31, 2027. (Letter, Sept. 15 | Watch Hearing)

Why It Matters

Hearing Highlights

Background on TRIA

RER’s Advocacy

RER will continue to work with CIAT and policymakers to ensure a long-term reauthorization of TRIA before its scheduled expiration in 2027.

Senate Finance Committee Ranking Member Ron Wyden (D-OR) introduced the bicameral Billionaires Income Tax Act this week with support from 20 Senate Democrats. The legislation mirrors the version first introduced by Sen. Wyden in 2023, and would tax the appreciation of wealthy individuals’ assets. Identical legislation was introduced in the House by Reps. Donald Beyer (D-VA) and Steve Cohen (D-TN). (PoliticoPro, Sept. 17)

Billionaires Income Tax Act (BITA)

Roundtable View

Roundtable Spotlight

McCormick was also a featured speaker on the Engineered Tax Services webinar this week to discuss the OB3 Act and its wide-ranging implications for commercial real estate, including permanent extensions of 100 percent expensing, Opportunity Zone incentives, affordable housing credits, and other key provisions. (Watch ETS Webinar)

Senate Democrats on Friday blocked a House-passed stopgap spending bill that would have funded federal agencies for seven weeks, setting the stage for a potential Oct. 1 government shutdown.

Government Funding & CRE

RER Town Hall

RER members also engaged in policy discussions on a number of policy priorities, including the implementation of the OB3 Act, Section 899 “revenge tax” concerns, Opportunity Zones, clean energy tax incentives, housing finance reform, and the future of TRIA.

On Wednesday, the Federal Reserve reduced its benchmark interest rate by 25 basis points, marking the first rate cut since December 2024. Central bank officials also projected two additional rate reductions this year, citing growing concerns about labor market softening and economic headwinds.

Fed’s Decision

Housing Impact

Implications for CRE

The Fed’s next rate decision is scheduled for Oct. 29, with the final FOMC meeting of the year set in early December.