U.S. Senate Finance Committee Chairman Chuck Grassley (R-IA) and Ranking Member Ron Wyden (D-OR) yesterday announced the formation of several bipartisan taskforces to examine and help permanently resolve the fate of 42 expired and expiring tax provisions. (Senate Finance Committee Announcement, May 16)

| |

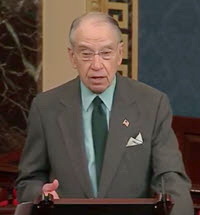

U.S. Senate Finance Committee Chairman Chuck Grassley (R-IA), above, and Ranking Member Ron Wyden (D-OR) yesterday announced the formation of several bipartisan taskforces to examine and help permanently resolve the fate of 42 expired and expiring tax provisions. (Senate Finance Committee Announcement and Video of Grassley statement, May 16) | |

- Among the expired provisions are a deduction for energy efficient commercial buildings (sec. 179D), the new markets tax credit, and the exclusion of income for debt forgiveness on a principal home. The committee members assigned to each task force are detailed in a committee news release.

- In conjunction with the announcement, the Joint Committee on Taxation (JCT) issued a report yesterday on the tax provisions that expired in 2017 and 2018, as well as those set to expire this year. The taskforces are expected to complete their work by the end of June. (Grassley statement, May 16)

- "We'll ask the taskforces to work with stakeholders, other Senate offices, and interested parties to consider the original purpose of the policy and whether the need for the provision continues today," said Chairman Grassley. "If so, we'll ask the taskforce to identify possible solutions that would provide long-term certainty in these areas." (Video of Grassley statement, May 16)

- Legislation supported by The Roundtable is currently pending to fix a technical error from the Tax Cut and Jobs Act regarding depreciation of interior building improvements, known as Qualified Improvement Property ("QIP"). (Roundtable Weekly, March 15 and QIP Policy Comment Letter, April 26)

- In the House, Ways and Means Committee Chairman Richard Neal (D-MA) has suggesting tax extenders should be part of a more comprehensive tax package. (CQ, March 16)

- This week, a Ways and Means hearing focused on "The Economic and Health Consequences of Climate Change." In his opening statement, Chairman Neal said, "Climate change is real. The business community understands this, and savvy companies are planning accordingly." He added, "… it's time for Congress to get on board. We cannot rely solely on the business community to solve this problem for us. The federal government has a significant role to play in creating real pathways for meaningful, long-term economic growth that creates solutions to reduce carbon emissions." (Chairman Neal's Opening Statement, May 15)

- The Real Estate Roundtable and a broad coalition of real estate and environmental organizations last week urged Senate and House tax writers to establish an accelerated depreciation schedule for a new category of Energy Efficient Qualified Improvement Property installed in buildings – or "E-QUIP." (Coalition E-QUIP Letter, May 8)

- Roundtable President and CEO Jeffrey DeBoer said, "The purpose of establishing a new E-QUIP category in the tax code is to stimulate productive, capital investment on a national level that modernizes our nation's building infrastructure while helping to lower greenhouse gas emissions. As Congress considers potential tax, infrastructure, and climate legislation, the E-QUIP proposal should have bipartisan appeal on a range of important policies prioritized by Republicans and Democrats." (Roundtable Weekly, May 10)

E-QUIP and tax extenders will be among several tax policy issues discussed during The Roundtable's June 11-12 Annual Meeting in Washington, DC.