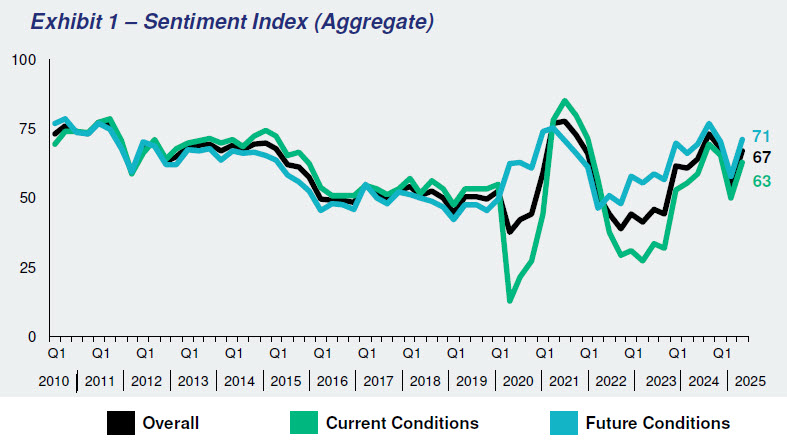

(WASHINGTON, D.C.) — The Real Estate Roundtable’s Q3 2025 Sentiment Index reflects increased confidence among commercial real estate executives as market conditions stabilize and sector-led growth emerges. The Q3 Index posted an overall score of 67, a 13-point increase from the previous quarter, with notable increases in both the Current (63) and Future (71) indices.

RER President and CEO Jeffrey DeBoer said, “Our Q3 Sentiment Index results show that market conditions have continued to stabilize in a meaningful way, supported by improved supply and demand. Commercial real estate executives are increasingly optimistic that the next 12 months will bring continued improvement. That said, certain property types continue to face headwinds, and capital access remains uneven across markets and sectors. Even so, the prevailing sentiment is that stability is returning and opportunities are emerging.”

While challenges remain, industry leaders see meaningful opportunities ahead, particularly in multifamily, data centers, and select office markets.

He added, “The provisions in the One Big Beautiful Bill Act should help accelerate this momentum— expanding housing supply, revitalizing communities, spurring job-creating investment nationwide, and strengthening the broader economy. Coupled with improving debt capital availability and stabilizing asset values, these policies set the stage for renewed growth. Moving forward, industry leaders and policymakers must continue to work together to promote investment, ensure credit access, and address persistent supply-demand imbalances in housing and other high-need property sectors.”

The Q3 Sentiment Index topline findings include:

Survey participants noted that the market is increasingly sector-specific, with performance tied closely to location, asset quality, and loan maturity schedules. Comments highlighted stabilizing fundamentals, renewed deal competition, and a narrowing bid-ask spread in transactions.

Some sample responses from participants in the Sentiment Index’s Q3 survey include:

“The market feels largely stable. There is still uncertainty about what lies ahead, yet conditions are far steadier than we have seen in recent years.”

“Real estate is a local business, and this cycle underlines how unique every market and product type really is. There is no ‘one-size-fits-all’ answer; it all depends on where you are, how favorable your product is, and the date of your loan maturity.”

“Debt is liquid with tight spreads; on the equity side it’s a ‘haves and have-nots’ market. Quality product will still get funded.”

Data for the Q3 survey was gathered by Chicago-based Ferguson Partners on RER’s behalf in July. See the full Q3 report.

The Real Estate Roundtable (RER) brings together leaders of the nation’s top publicly-held and privately-owned real estate ownership, development, lending and management firms with the leaders of major national real estate trade associations to jointly address key national policy issues relating to real estate and the overall economy.