The wide-ranging impact of remote government work policies on office occupancy rates and CMBS exposure is the focus of a March 31 Trepp report that analyzed 20 metropolitan statistical areas (MSAs) with federal, state, and municipal governments as tenants. (TreppTalk, Seeking Office Answers? Look to the Largest Office Tenant… Government)

The wide-ranging impact of remote government work policies on office occupancy rates and CMBS exposure is the focus of a March 31 Trepp report that analyzed 20 metropolitan statistical areas (MSAs) with federal, state, and municipal governments as tenants. (TreppTalk, Seeking Office Answers? Look to the Largest Office Tenant… Government)

Remote Government Workforces

- The federal government is the largest tenant of office spaces throughout the U.S. and its General Services Administration (GSA) leases over 43 million square feet, which equals one-third of the overall market. (Trepp, March 31 and Commercial Observer, Feb. 27)

- Trepp notes, “The strategy the government deploys to get its workers back to the office will have a cascading effect on the rest of the CRE market.”

- A recent Washington, DC financial forecast projected tax revenue will plunge nearly a half-billion dollars from 2024-2026 due to remote work’s influence, reduced office transactions, and dropping asset values. (BisNow and DCist, March 1)

Occupancy Rate Comparison by Geography

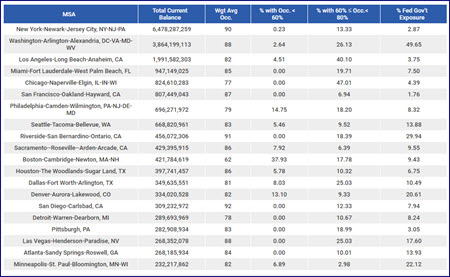

- The Trepp table above shows the 20 MSAs with the largest outstanding loan balances for properties that have federal, state, and municipal governments as tenants. (Table data points in Excel here)

- The analysis included 1,365 government-occupied properties across 837 loans, with a total outstanding loan balance of $25.9 billion. The majority of these loans with exposure to one or more government tenants are backed by office or mixed-use properties.

- Prolonged uncertainty about return-to-office policies for GSA entities may eventually reduce current office space allocations. If government tenants vacate some of their offices, net operating income (NOI) could fall, adding more pressure on the loans that back these properties.

SHOW UP Act

- The House of Representatives recently passed legislation—the Stopping Home Office Work’s Unproductive Problems (SHOW UP) Act (H.R. 139)—that would require all federal agencies to revert to pre-pandemic telework office arrangements and allow employees 30 days to return to their offices. (GovExec, Feb. 1 and The Hill, Feb. 2)

- The Real Estate Roundtable wrote to President Joe Biden last December about the need for federal employees to return to their workplaces—and encouraged the administration to support legislation that could incentivize the conversion of underutilized buildings to more productive use such as housing. (Roundtable Weekly, Feb. 3 | GlobeSt and CoStar, Dec. 15, 2022)

- Roundtable President and CEO Jeffrey DeBoer discussed the remote work issue this week on the Walker Webcast, hosted by Roundtable Member Willy Walker (Chairman & CEO, Walker & Dunlop).

- DeBoer commented on the impact of employees working from home. “If they’re not downtown, the small businesses suffer. The parking garages suffer. Transportation suffers, safety issues suffer, and the tax base suffers,” he said. “This is why we’re focused on getting people back to the office as much as possible.” (Connect CRE, April 5)

Trends in remote work, its ongoing impact on commercial real estate markets, and the SHOW UP Act will be topics for discussion during The Roundtable’s Spring Meeting on April 24-25 in Washington, DC (Roundtable-level members only).

# # #

The wide-ranging impact of remote government work policies on office occupancy rates and CMBS exposure is the focus of a March 31 Trepp report that analyzed 20 metropolitan statistical areas (MSAs) with federal, state, and municipal governments as tenants. (TreppTalk, Seeking Office Answers? Look to the Largest Office Tenant… Government)

The wide-ranging impact of remote government work policies on office occupancy rates and CMBS exposure is the focus of a March 31 Trepp report that analyzed 20 metropolitan statistical areas (MSAs) with federal, state, and municipal governments as tenants. (TreppTalk, Seeking Office Answers? Look to the Largest Office Tenant… Government)