The federal government shut down on Wednesday—the first lapse since 2019—with no deal in sight. Both chambers are at an impasse after dueling stopgap funding bills failed again this week. (AP News, Oct. 2)

State of Play

CRE Impact

As the shutdown continues, mounting strain on real estate transactions, insurance coverage, and investment planning will intensify pressure on Congress to resolve the impasse.

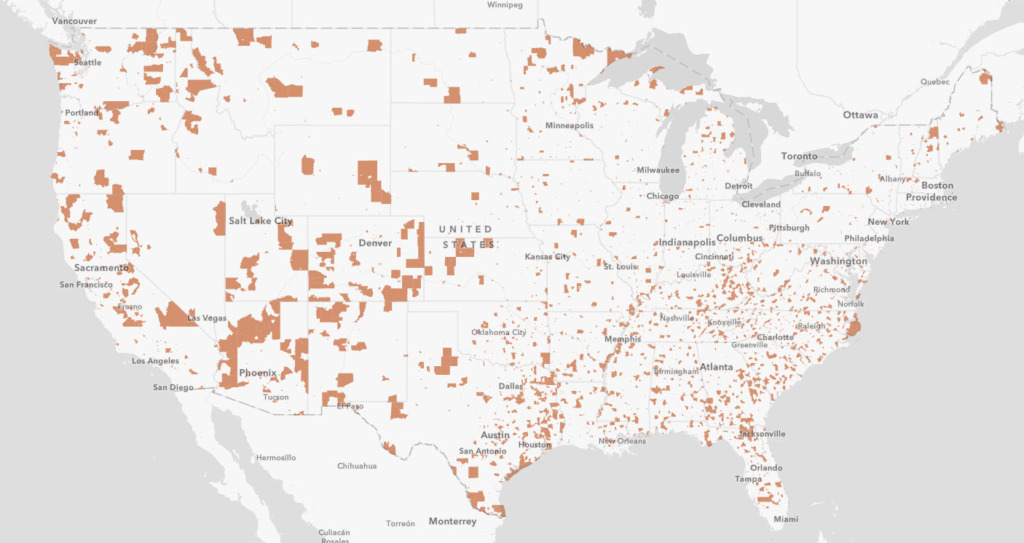

The Treasury Department and Internal Revenue Service (IRS) this week issued Notice 2025-50, providing guidance on Opportunity Zone (OZ) investments in rural areas under the One Big Beautiful Bill (OB3) Act. The notice designates 3,309 census tracts—about 38% of the OZ map—as rural, giving investors and developers clarity on how the new rules apply. (IRS, Sept. 30)

New Guidance

Roundtable Advocacy

Why It Matters

RER’s Tax Policy Advisory Committee (TPAC) and Opportunity Zone Working Group will continue to evaluate OZ changes, address technical issues, and ensure the industry’s voice is heard as Treasury and IRS implement the new law.

The Trump administration announced new trade measures this week aimed at building materials. The plan imposes a 10% duty on imported softwood lumber and a 25% tariff on kitchen cabinets and vanities—set to rise to 50% in 2026. The added cost burden threatens to ripple through the housing market, raising barriers to affordability at a time of heightened demand. (White House, Sept. 29) (NYT, Oct. 2)

State of Play

CRE & Affordable Housing

RER will continue to engage with policymakers to reduce regulatory burdens and eliminate other obstacles that are impeding development and expand America’s housing infrastructure.