The U.S. House of Representatives passed the bipartisan SPEED Act (H.R. 4776) on Thursday by a 221–196 vote, advancing legislation aimed at streamlining federal permitting reviews to accelerate energy and infrastructure development amid surging electricity demand and rising power costs. (Axios, Dec. 18)

State of Play

Roundtable Advocacy

What’s Next

Permitting reform will be a featured topic at RER’s next all-member State of the Industry Meeting on Jan. 21–22, 2026, in Washington, D.C., as policymakers consider strategies to accelerate energy infrastructure and support long-term economic growth.

This week, the House Financial Services Committee (HFSC) advanced 20 bills during a two-day markup session—including the bipartisan Housing for the 21st Century Act (H.R. 6644), which contains numerous reforms championed by The Real Estate Roundtable (RER) and a coalition of national real estate and housing organizations. (Letter, Dec. 15)

Comment Letter Highlights

Housing for the 21st Century Act Advances

NFIP Reauthorization Advances

RER will continue to engage with policymakers in support of legislation that increases housing supply and ensures that property owners can access the insurance protection that they need from increasingly costly natural disasters.

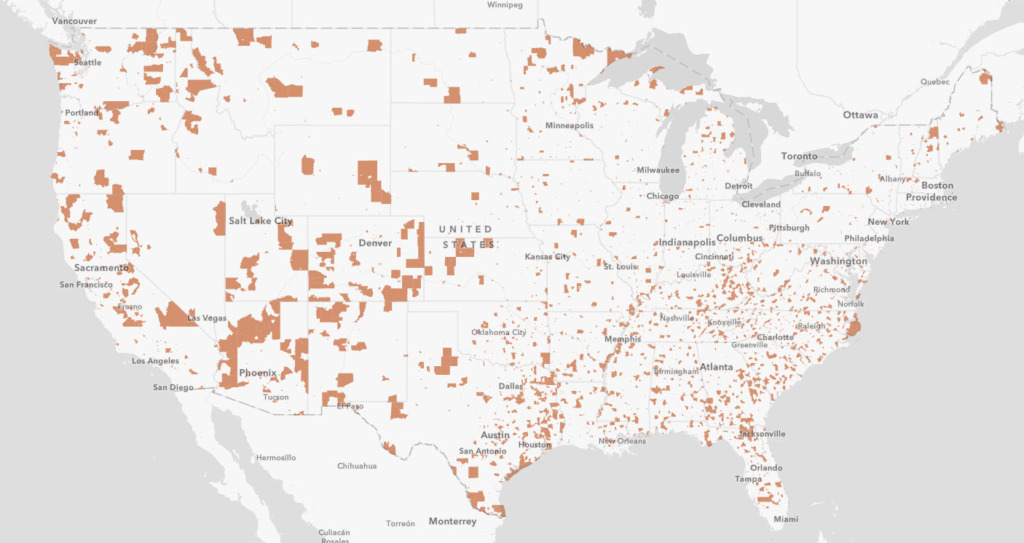

The Real Estate Roundtable (RER) submitted a comment letter this week, urging the Treasury Department and IRS to issue expedited guidance to ensure Opportunity Zone (OZ) investment continues uninterrupted in 2026 as the program transitions from Opportunity Zones 1.0 to the permanent Opportunity Zones 2.0 framework enacted in the One Big Beautiful Bill (OB3) Act. (Letter, Dec. 19)

Roundtable Advocacy

Why It Matters

Prompt administrative guidance is essential to prevent a policy gap in 2026 and keep capital, jobs, and housing investment flowing to the communities OZs were designed to serve. OZs will be discussed at the next in-person TPAC meeting at RER’s State of the Industry Meeting scheduled for Jan. 21-22, 2026.

The Real Estate Roundtable (RER) filed an amicus brief this week with the Second Circuit Court of Appeals in Soroban Capital Partners LP v. Commissioner, a case that challenges the IRS’s restrictive interpretation of the “limited partner exception” from self-employment (SECA) taxes under section 1402(a)(13) of the tax code. (Amicus Brief, Dec. 15)

Why It Matters

Roundtable View

Background

Next Steps

The decision in any of the pending cases could have nationwide implications for how partnerships are treated under SECA. A ruling against the Tax Court’s passive investor test would reinforce state law’s central role in defining “limited partner” status.

The Roundtable’s policy news digest will resume publication on Friday, January 9, 2026.

Recent issues of Roundtable Weekly can be searched by keyword here.