A “carried” interest is the interest in partnership profits a general partner receives from the investing partners for successfully managing the investment and bearing the entrepreneurial risk of the venture. Carried interest may be taxed as ordinary income or capital gain, depending on the type of revenue the partnership generates. Legislation proposing to change the tax treatment of carried interest has been introduced in various forms since 2007.

The tax code should continue to reward risk-taking, and Congress should reject legislative proposals that would limit capital gains treatment to invested cash.

Carried interest is not compensation for services. Carried interest is granted for the value the general partner adds to the venture beyond routine services, such as business acumen, experience, and relationships. It is also a recognition of the risks the general partner takes with respect to the general partnership’s liabilities. These risks can include funding pre-development costs, guaranteeing construction budgets and financing, and exposure to potential litigation over countless possibilities.

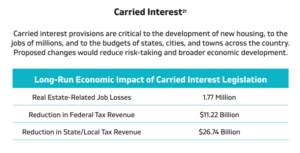

Carried interest tax proposals would make it more expensive to build or improve real estate and infrastructure, including workforce housing, assisted living communities, industrial properties, and more, especially in long-neglected neighborhoods or on land with potential environmental contamination.

Taxing all carried interests in partnerships as ordinary income would be a huge tax increase that would drive significant investment from the economy and harm the nearly 8 million partners in U.S. real estate partnerships.

The real estate industry utilizes partnerships with carried interests on projects ranging from small property development to large multi-billion-dollar investment funds. Businesses, large or small, in all areas, use partnerships as their business entity of choice and include some form of carried interest incentive. In typical real estate partnerships, before a financial partner enters the picture, a developer typically spends 3-5 years and hundreds of thousands to millions of dollars in architectural, engineering, consulting, and legal costs to bring the land to a buildable state—through zoning, plans, studies, and approvals.

A carried interest is, first and foremost, an interest in the partnership. Its amount and timing depend on the success of the partnership venture. Because it is a long-term, risk-based investment, it is not paid contemporaneously, nor is it guaranteed. Regardless of paper profits that might exist throughout the course of the investment, actual profit only exists when the asset is sold.

For more information and recent updates, reference our resources below.