The Senate yesterday approved funding to keep the government open through March 11, allowing congressional negotiators an additional three weeks to reach a spending deal for fiscal year 2022. (CQ, Feb. 18)

From CR to Omni

Roundtable & Energy Measures

The Senate returns on Feb. 28 for President Biden’s first State of the Union address on March 1, which will be followed by the administration’s FY2023 budget request.

# # #

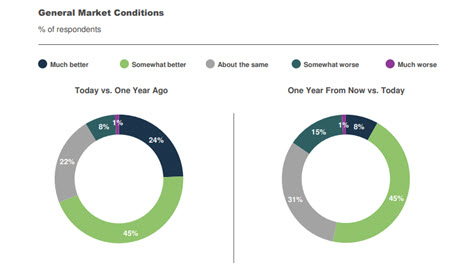

As the economy continues to recover from the global pandemic, commercial real estate executives see strong market fundamentals and steady economic growth, according to The Real Estate Roundtable’s Q1 2022 Economic Sentiment Index. While optimistic about the economic outlook going forward, inflation concerns and a rising interest rate environment are frequently cited as potential headwinds for the industry.

Market Conditions

Topline Findings

Data for the Q1 survey was gathered in January by Chicago-based Ferguson Partners on The Roundtable’s behalf. See the full Q1 report.

# # #Robust international travel helps power economic growth and commercial real estate through tourism dollars directly spent at U.S. hotels, resorts, stores, home purchases, attraction, and investment properties. That is the message to policymakers from the multi-industry VisitU.S. Coalition, which aims to safely and securely welcome more overseas travelers to the U.S. – who stay an average of 18 nights and spend approximately $4,360 at hotels, stores, restaurants and attraction properties on business and leisure trips. (VisitU.S. Policy Agenda)

|

The multi-industry VisitU.S. Coalition aims to safely and securely welcome more overseas travelers to the U.S. – who stay an average of 18 nights and spend approximately $4,360 at hotels, stores, restaurants and attraction properties on business and leisure trips. ( VisitU.S.Policy Agenda ) |

Led by the U.S. Travel Association and the American Hotel and Lodging Association, the VisitU.S. coalition also includes The Real Estate Roundtable, U.S. Chamber of Commerce and the American Resort Development Association.

A Federal Communications Commission (FCC) order released Tuesday aims to nullify arrangements between broadband providers and building owners to deliver efficient and cost effective internet service for residential and business tenants. (Bloomberg, Feb. 15)

The bipartisan Infrastructure Investment and Jobs Act (IIJA) invests roughly $65 billion “to help ensure that every American has access to reliable high speed internet.” (Bipartisan Infrastructure Law Guidebook, “Broadband” section)

The Roundtable will continue to work with coalition partners to promote speedy and proper disbursement of IIJA funds for broadband and other infrastructure projects, while preserving the rights of owners to manage their buildings and meet their tenants’ demands.

# # #