Fed Chair Jerome Powell and Treasury Secretary Janet Yellen this week said that federal regulators are closely monitoring bank loan concentrations in office properties for heightened economic risk but view the CRE sector’s financial challenges as manageable. (60 Minutes’ Powell transcript, Feb. 3 and Bloomberg video of Yellen testimony, Feb. 6)

Regulators Focus on CRE

CRE Markets

Separately, The Federal Reserve Board recently announced that its Bank Term Funding Program will cease making new loans on March 11. The program remains available as an additional source of liquidity for eligible institutions until that date. (Fed news release, Jan. 24)

# # #

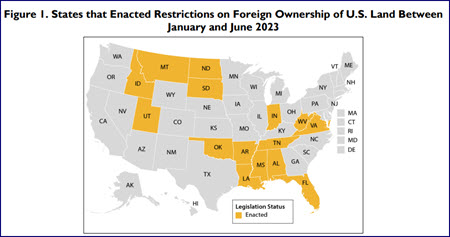

A federal appeals court recently blocked enforcement of a Florida law that could have negative consequences for foreign investment in U.S. property and agriculture land. The Real Estate Roundtable has urged Florida officials for months to consider changes to the interpretation of the law’s broad language. As currently written, the measure could prevent U.S.-managed funds from pursuing investment opportunities in the state if there is any level of investor participation in the fund from “countries of concern.” (Roundtable Weekly, Feb. 2 and Dec. 15 | Reuters and WFTV, Feb. 2)

Foreign Investment in U.S. Property

SB 264 & FIRRMA

Oral arguments in Shen v Simpson are scheduled for this April. (Appeals Court order)

# # #

This week, the Treasury Department’s Financial Crimes Enforcement Network (FinCEN) proposed a rule that would require certain real estate professionals involved in the closing or settlement of residential transfers to report information to FinCEN about the beneficial owners of legal entities and trusts involving all-cash transactions. The rule would not require the reporting of sales to individuals. (Reuters and AP, Feb. 7)

FinCEN’s Initiatives

Small Business Registry

Industry Response

The Roundtable also signed onto a letter with approximately 70 business groups on Nov. 16, 2023 that urged Congress to pass a one-year delay in implementing the rules.

# # #