Democrats scaled down their ambitions for a budget reconciliation bill in the wake of Sen. Joe Manchin’s (D-WV) recent rejection of any climate and tax legislative package. Instead, congressional Democrats this week focused on a limited prescription drug pricing and health care subsidy bill as President Biden announced executive actions to make progress on climate initiatives. (Roundtable Weekly, July 15 and New York Times, July 20)

Senate Democrats Pivot

White House Climate Action

Trends in CRE, the congressional agenda, and the upcoming lame-duck session of Congress after the mid-term elections will be among the topics discussed during The Roundtable’s Fall Meeting on Sept. 20-21 in Washington, DC.

# # #

Numerous congressional committees have recently addressed the nation’s scarcity of affordable housing—including this week’s Senate Finance Committee hearing, “The Role of Tax Incentives in Affordable Housing,” which focused on the Low Income Housing Tax Credit (LIHTC) and other legislative incentives.

Tax Focus

Congressional Hearings

The Roundtable’s Real Estate Capital Policy Advisory Committee (RECPAC) has formed an Affordable Housing Working Group, which is working with the Research Committee to develop proposals on expanding the nation’s housing infrastructure.

# # #

The Federal Reserve Board on July 19 invited comment on a proposal that implements the Adjustable Interest Rate (LIBOR) Act, which Congress enacted last year. The LIBOR Act provides a safe harbor for market participants who need to switch existing LIBOR-referencing financial contracts to a replacement benchmark for debt instruments before LIBOR reaches its final replacement date on June 30, 2023. (The Fed’s Notice of Proposed Rulemaking, July 19 and Roundtable Weekly, March 11)

The Roundtable welcomes comments from its members on the proposed rulemaking and plans to work with its Real Estate Capital Policy Advisory Committee (RECPAC) on a response. For any questions, please contact The Roundtable’s Senior Vice President Chip Rodgers or call 202-639-8400.

# # #

Over 2,500 small-business owners gathered on Capitol Hill this week to meet with more than 400 lawmakers and federal officials to urge reauthorization of the Small Business Administration (SB) for the first time in over 20 years. Small businesses throughout the nation are facing inflationary pressures, supply chain shortages, labor challenges, limited access to capital and a looming possibility of recession. (The Hill, July 20)

10,000 Small Businesses

Owner Challenges

Industry Views

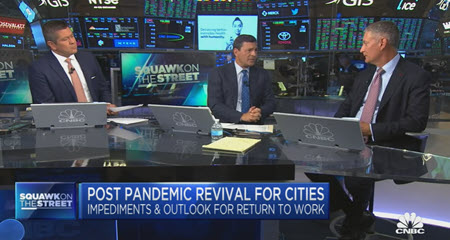

CNBC’s Squawk on the Street this week featured two interviews with commercial real estate leaders. CBRE CEO Robert Sulentic and Roundtable member Marty Burger (Chief Executive Officer, Silverstein Properties) commented on commercial real estate market conditions, including office conversions to rental housing and the return-to-office trend. (Burger interview | Sulentic interview)

In this week’s Walker Webcast, Dr. Peter Linneman (Principal, Linneman Associates, KL Realty and CEO, American Land Fund) was interviewed by Roundtable Member Willy Walker (Chairman and Chief Executive Officer, Walker & Dunlop). (Bisnow, July 21)

Dr. Linneman commented that inflation is transitory with supply lagging demand due to 23% of the workforce collecting unemployment insurance. He also offers his views on national debt concerns, the Fed and interest rates, and return-to-the-office concerns. (Watch “The Best Hour in CRE” with Economist Peter Linneman, July 21)

# # #