Lawmakers have removed the Section 899 provision known as the “revenge tax” from the reconciliation package after the Treasury Department secured an international tax agreement with G7 countries. The Real Estate Roundtable (RER) strongly advocated for changes to the measure, warning that the tax would have deterred foreign investment in U.S. commercial real estate and weakened capital formation. (AP News, June 26)

Why It Matters

RER Advocacy

The removal of Section 899 represents a meaningful policy outcome for commercial real estate, helping to protect investment flows and market stability. RER will continue working with Congress to ensure the final tax package supports capital formation, economic growth, and job creation.

Senate Republicans are racing to rewrite significant portions of their sweeping reconciliation bill in an effort to vote before the July 4 recess. Parliamentarian rulings, unresolved tax and Medicaid issues, and opposition from fiscal hawks and House conservatives are testing the goal of delivering the legislation to President Trump’s desk by the holiday.

State of Play

Energy Tax Incentives

RER Homeland Security Task Force Engaged Amid Iran Conflict

Congress is expected to work through the weekend as Senate leaders try to finalize the reconciliation package and set up potential floor votes before the July 4 recess.

As Congress works to meet a July 4 deadline for sweeping reconciliation legislation, The Real Estate Roundtable (RER) and partner organizations are calling on Senate leaders to align with House-passed tax measures that strengthen Main Street businesses by expanding the Section 199A deduction, protecting the Opportunity Zones program, and advancing a lower capital gains rate to drive long-term investment.

Section 199A

Opportunity Zones

Capital Gains Bill Introduced

As negotiations continue, RER remains focused on advancing tax policies that foster capital formation, protect real estate investment, and support Main Street employers nationwide.

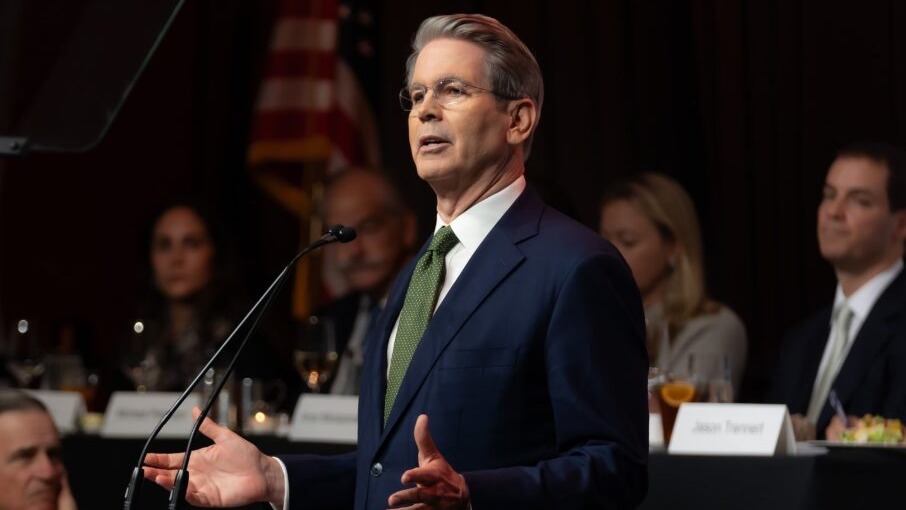

In a busy week for Fed policy, Federal Reserve Chair Jerome Powell delivered his semiannual monetary policy report to Congress, testifying at a pair of House and Senate hearings on the state of the U.S. economy. Powell also fielded questions from policymakers on a new proposal unveiled this week to ease capital requirements for large banks and the state of Basel III Endgame.

Policy Outlook

The Fed’s New Proposal

Basel III Endgame

Chair Powell’s term at the Fed isn’t up until May 2026—but reports indicate that President Trump is considering announcing his pick to succeed Powell far in advance, potentially a candidate who is more amenable to lowering interest rates on an accelerated timeline.