This week, The Real Estate Roundtable and 35 other national business organizations urged leaders of the Senate and House tax-writing committees to preserve long-standing tax rules governing like-kind exchanges (LKEs). The April 10 letter encouraged policymakers to reject proposals, such as those in President Biden's budget, to restrict the use of LKEs. (Coalition letter, April 10)

Value of LKEs

Widespread Use

House Tax Hearings

The $79 billion tax package passed by the House includes Roundtable-supported measures on business interest deductibility, bonus depreciation, and the low-income housing tax credit (LIHTC), but continues to face hurdles in the Senate. The Roundtable and 21 other industry organizations that comprise the Housing Affordability Coalition urged the Senate on Feb. 15 to pass the tax package.

A bipartisan Senate bill introduced on April 3 would increase oversight of federal telework policies after a recent report showed government agency headquarters in Washington, DC are using an average of 12% of their office space. (Committee news release and Public Buildings Reform Board report)

Congressional Push

Roundtable Efforts

Policymaker guests will include House Minority Leader Hakeem Jeffries (D-NY), House Financial Services Committee Member Rep. French Hill (R-AR), and Jared Bernstein, chairman of the White House Council of Economic Advisers.

# # #

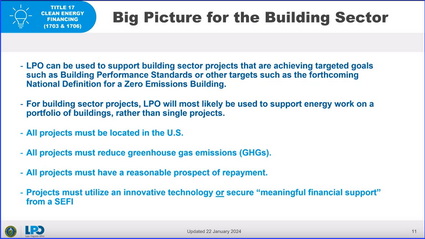

The U.S. Department of Energy (DOE) announced a new financing program this week for states to access federal funds that could help real estate owners meet state, city, and county building performance standards (BPS).

State Energy Financing Institutions

Funding Criteria

The Roundtable’s Sustainability Policy Advisory Committee (SPAC) continues to work closely with the White House and DOE on climate initiatives impacting commercial real estate.

# # #

Real estate industry research pioneer Ray Torto passed on April 7 after an accomplished professional career spanning roles in academia, government, and the private sector that included service as chairman of The Real Estate Roundtable’s Research Committee. (Torto obituary)

After Ray retired from CBRE, he returned to the classroom to become a lecturer at the Harvard Graduate School of Design. Reflecting on his career in an interview in 2014, Ray said that his favorite part of the real estate industry was the many people he worked with over the years. An additional interview from 2017 is available from The Counselors of Real Estate (CRE).

# # #