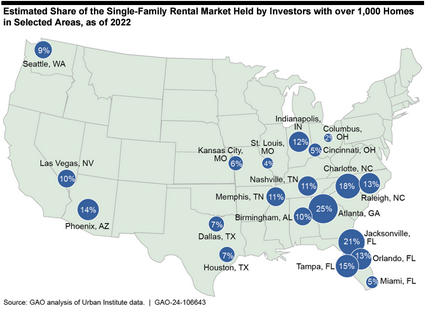

President Donald Trump on Wednesday said he would move to ban “large institutional investors” from purchasing single-family homes, framing the proposal as part of a broader push to improve housing affordability. (Washington Post | CNBC, Jan. 7)

State of Play

What the Data Shows

Roundtable View

Without meaningful steps to expand housing supply, proposals to limit institutional participation are unlikely to address the root causes of affordability pressures facing renters and would-be homebuyers, reinforcing RER’s ongoing work with policymakers and the administration to promote policies that increase housing supply and improve affordability.

A bipartisan, three-bill “minibus” appropriations package advanced by the House on Thursday preserves funding for ENERGY STAR, ensuring continued support through the end of the federal fiscal year for the voluntary public-private partnership focused on energy efficiency in buildings and appliances. (PoliticoPro, Jan. 8)

State of Play

Why It Matters

What’s Next

These developments, alongside issues related to AI-driven power demand, grid reliability, and permitting reform, will be featured at RER’s upcoming Sustainability Policy Advisory Committee (SPAC) meeting on Jan. 21 in Washington, D.C.

After months of negotiations, global tax talks produced an agreement at the Organization for Economic Co-operation and Development (OECD) that exempts U.S.-headquartered companies from Pillar Two’s global minimum tax and reduces the risk of retaliatory taxes that could have affected foreign investment in commercial real estate. (ABCNews, Jan. 6)

State of Play

Why It Matters

RER's Tax Policy Advisory Committee (TPAC) will review implications for U.S. real estate investment and global capital flows at the State of the Industry Meeting on Jan. 22, 2026, in Washington, D.C.