The nation’s housing policy landscape is shifting rapidly as the Trump administration and Congress push forward on multiple fronts—spanning GSE reform, regulatory rollback, and bipartisan legislative efforts to expand affordable housing tools. The Real Estate Roundtable (RER) remains engaged on these developments, reinforcing its priorities through direct advocacy and coalition efforts.

GSE Reform

- This week, President Trump said he’s “giving very serious consideration” to taking government sponsored enterprises (GSEs) Fannie Mae and Freddie Mac public—reigniting debate over the future of the mortgage giants. (WSJ, May 21)

- “I am giving very serious consideration to bringing Fannie Mae and Freddie Mac public,” Trump posted Wednesday on Truth Social. Trump also said he would consult with Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick, as well as the GSEs’ chief regulator, Federal Housing Finance Agency head William Pulte. (Politico, May 21)

- The GSEs have been in federal conservatorship since 2008, and Congressional action would likely be required to change their legal status.

- While no active legislative proposals exist, some GOP lawmakers are discussing the sale of the government’s stakes in the GSEs as a potential offset for extending tax cuts. (Politico, May 21)

- RER supports sensible GSE reform that balances taxpayer protection with ensuring financial stability and continued liquidity for ownership, rental housing, and underserved markets.

Roundtable Advocacy

- This week, RER joined a coalition of 15 national real estate organizations urging the Department of Labor to repeal and revise its 2023 Davis-Bacon rule. (Letter, May 20)

- In the letter sent to Department of Housing and Urban Development (HUD) Secretary Scott Turner and Labor Secretary Lori Chavez-DeRemer, the coalition applauded the administration’s focus on affordability and supply, and called for an end to outdated wage classifications that drive up project costs.

- The current rule increases housing construction costs by up to 20% and deters developer participation in federally funded projects.

- The letter recommends suspending enforcement and launching a formal rulemaking to streamline compliance and reduce regulatory risk.

- In a separate letter, RER voiced strong support for the bipartisan Housing Affordability Act introduced (S.1527) by Senators Ruben Gallego (D-AZ) and Dave McCormick (R-PA) to modernize the FHA multifamily insurance program. (Letter, May 13)

- Outdated statutory limits, unchanged since 2003, are suppressing the number of insurable housing units and acting as a barrier to middle-income housing development.

- Updating the limits would unlock private capital, free up federal resources, and bring the program in line with modern construction costs.

LIHTC Expansion Clears the House

- The reconciliation bill that passed in the House this week includes major provisions from the Affordable Housing Credit Improvement Act (AHCIA), marking the most significant increase in Low-Income Housing Tax Credit (LIHTC) resources in 25 years. (Affordable Housing Finance, May 22)

- Although the entire bill was not incorporated into the package, the elements that were included still amount to a significant expansion of the program.

- The elements included in the bill—increase the 9% credit volume cap, lower the bond financing threshold to 25% for 4% housing credit projects, and authorize up to a 30% basis boost for rural and tribal developments.

Federal Land Sales to Expand Housing Supply

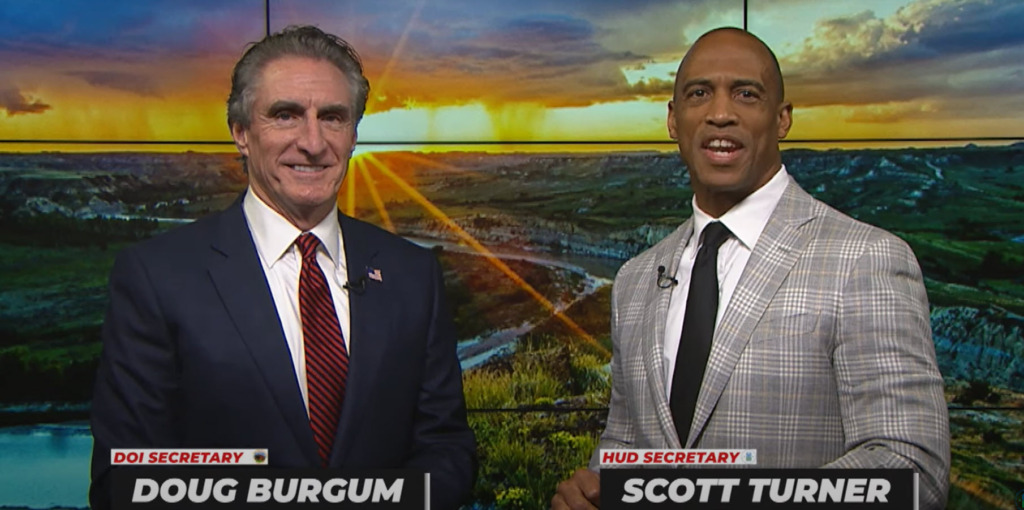

- HUD Secretary Scott Turner and Interior Secretary Doug Burgum are advancing the administration’s plan to sell underutilized federal land for new housing construction. (Bloomberg, May 22)

- Their coordinated effort aims to unleash more of the government’s 640 million acres for development—particularly affordable and workforce housing. (PoliticoPro, May 20)

RER will continue to advocate for smart, market-based solutions that expand housing supply, reduce regulatory barriers, and support investment across the full spectrum of the nation’s housing needs.