This week, the House overwhelmingly passed the bipartisan Housing for the 21st Century Act (H.R. 6644). Following Monday’s vote on this sweeping bill, the House Financial Services Committee (HFSC) held a hearing on Tuesday to examine how policies in the financial services and housing sectors contributed to rising cost-of-living pressures for American families by restricting access to capital and credit. On Wednesday, the Subcommittee on Housing and Insurance held a hearing to examine housing affordability and the role of the secondary mortgage market.

Housing for the 21st Century Act

- On Monday, the House approved the bipartisan Housing for the 21st Century Act by a 390-9 vote, marking one of the strongest bipartisan housing votes in recent years. (The Hill, Feb. 10)

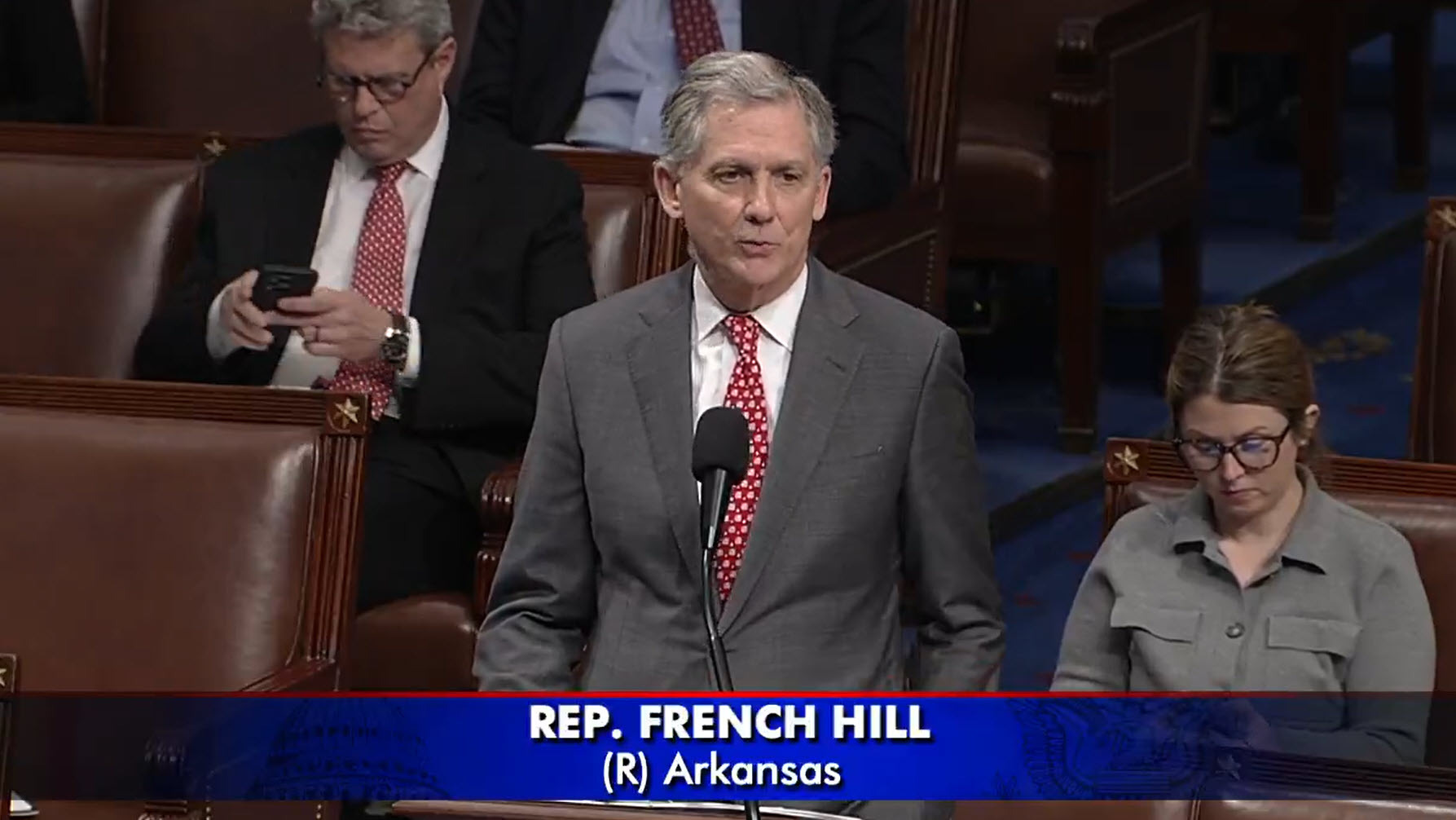

- Led by HFSC Chairman French Hill (R-AR) and Ranking Member Maxine Waters (D-CA), the legislation includes provisions to streamline housing production and affordability by updating outdated programs, removing unnecessary federal requirements, increasing local flexibility, and allowing banks to more freely deploy funding. (The Hill, Feb. 10 | Comment Letter, Feb. 6)

- The bill addresses a housing shortfall of up to 5.5 million units, driven by regulatory delays, zoning constraints, and rising construction costs. (The Hill, Feb. 6)

- In a Feb. 6 letter to Congress, The Real Estate Roundtable (RER) joined a group of national real estate and housing organizations in expressing “strong support” for the measure, commending the HFSC for advancing “practical, solutions-oriented housing policy.” (Comment Letter, Feb. 6)

- The coalition added that the bill “supports increased housing supply, improved access to homeownership, and appropriate consumer protections, particularly in high-cost and underserved communities.” (Comment Letter, Feb. 6)

- The bill’s passage in the House sets up negotiations with the Senate, which passed its own housing legislation—the ROAD to Housing Act—late last year. The two bills contain similar supply-side reforms but differ on certain grant programs and community bank provisions. (Punchbowl News, Dec. 14)

Hearing on Affordability Crisis

- On Feb. 10, the HFSC held a hearing titled, “Priced Out of the American Dream: Understanding the Policies Behind Rising Costs of Housing and Borrowing,” focused on legislative and regulatory proposals to address the affordability crisis. (HFSC Hearing, Feb. 10)

- The hearing noticed three proposals to restrict institutional investment in single-family rentals (SFRs)—a topic that has gained momentum following a related Executive Order issued last month. However, the SFR issue surfaced only briefly during Tuesday’s session, and none of the restrictive measures advanced. (Executive Order, Jan. 20)

- In a Feb. 10 comment letter to HFSC leadership, RER and national real estate trade groups cautioned against limiting institutional capital in the housing market, including SFR assets. (Comment Letter, Feb. 10)

- The letter explained, “There is no evidence that institutional investors are crowding out prospective homebuyers,” citing data showing that institutional investors accounted for just 0.3 percent of the $2 trillion in single-family home purchases over the past year. (Comment Letter, Feb. 10)

- The letter highlighted the positive developments that institutional investors have contributed to the market, stating, “Institutional SFR investment expands rental supply in markets where it was previously limited, increases access to high-opportunity neighborhoods, and benefits households with lower incomes, wealth, and savings.” (Comment Letter, Feb. 10)

- RER and coalition partners also urged lawmakers to avoid policies that would restrict capital formation and instead prioritize supply-forward reforms to close the nation’s housing gap. (Comment Letter, Feb. 10)

Homeownership and the Secondary Mortgage Market

- On Feb. 11, the HFSC’s Subcommittee on Housing and Insurance held a hearing titled, “Homeownership and the Role of the Secondary Mortgage Market,” examining the structure, function, and evolution of the market and how the government-sponsored enterprises (GSEs) Fannie Mae and Freddie Mac impact housing affordability. (HFSC Subcommittee Hearing, Feb. 11)

- In his opening remarks, Subcommittee Chairman Mike Flood discussed the importance of liquidity and capital efficiency in today’s regulatory environment.

- “The secondary mortgage market works to provide greater liquidity for lenders and results in greater access to mortgage lending for borrowers. In today’s banking regulatory climate, holding a mortgage on a bank’s balance sheet can result in significant capital costs,” Chairman Flood said. (Rep. Flood Press Release, Feb. 11)

- Chairman Flood added that no legislation was noticed during the hearing, as the session was intended to explore the subject matter in-depth.

- Bob Broeksmit, President and CEO of the Mortgage Bankers Association, touched on the substantial role that GSEs play in the secondary market. He also advocated that any reforms enacted to end the GSEs’ government conservatorship provide “an ample runway to ensure deep, liquid secondary markets for single-family and multifamily mortgages through all economic cycles and in all geographic regions.” (MBA Testimony, Feb. 11)

RER will continue engaging lawmakers in both chambers to advance durable housing solutions and sensible GSE reforms that support homeownership, expand affordable housing supply, and sustain economic growth.