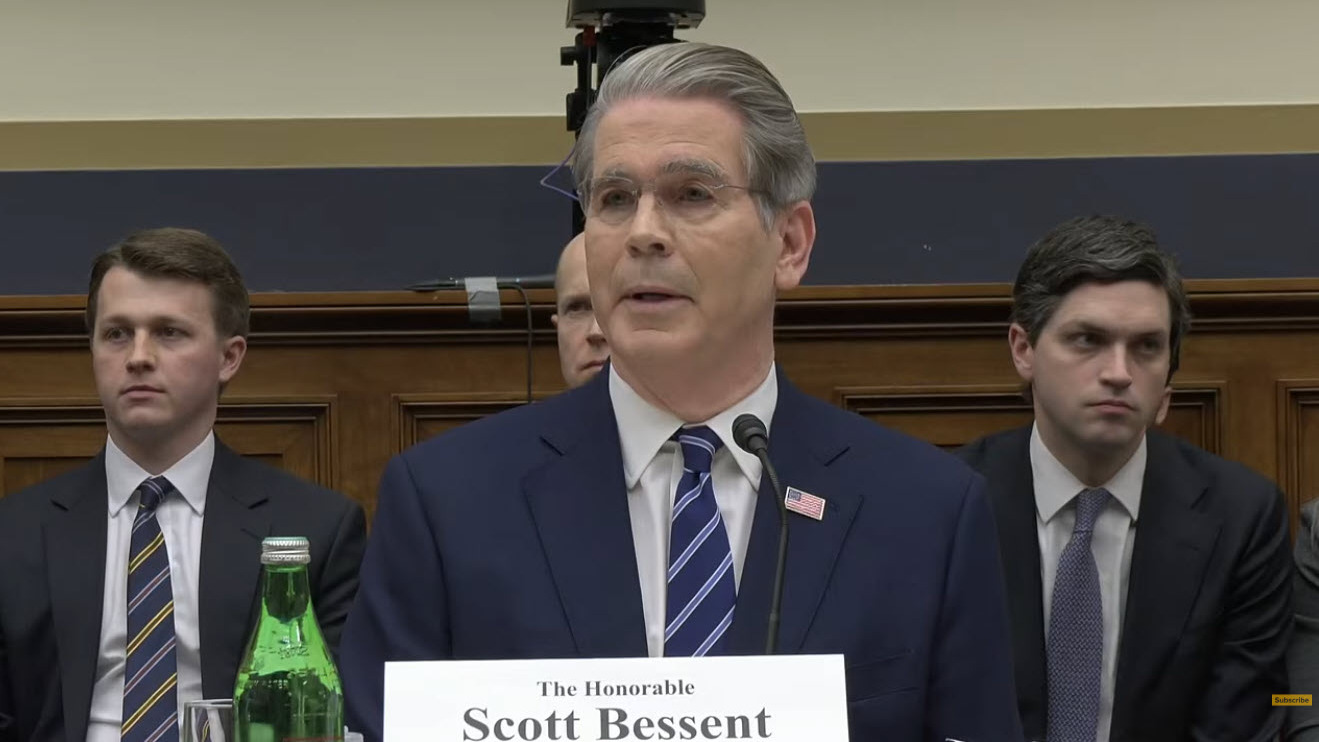

This week, the House Financial Services Committee (HFSC) and Senate Banking, Housing and Urban Affairs Committee held hearings with Treasury Secretary Scott Bessent to review the Financial Stability Oversight Council’s (FSOC) 2025 Annual Report. Lawmakers used the session to raise broader concerns about financial regulation, capital formation, and credit availability, including attention on FSOC’s role in banking regulation.

FSOC and Regulatory Direction

- In his testimony, Sec. Bessent described a recalibrated approach at FSOC that focuses on identifying specific risky activities, rather than broadly regulating entire firms or sectors. He criticized prior “regulation by reflex” and stated that FSOC should avoid labeling wide swaths of the financial system as vulnerable, absent clear, material risk. (Watch Hearing)

- “FSOC should… work with its members to support efforts to avoid or pare back existing regulation that stifles pro-growth lending, capital formation, and innovation. And the best way to achieve these goals is by centering economic growth and economic security at the heart of FSOC’s agenda,” Sec. Bessent said. (Politico Pro, Feb. 4)

- Several exchanges focused on FSOC’s authority to designate nonbank financial companies as Systemically Important Financial Institutions (SIFIs). Sec. Bessent confirmed a preference for an activities-based framework, signaling openness to clearer standards and restraint in the use of entity-based designations. (Watch Hearing)

- Sec. Bessent added that he would propose new nonbank guidance later this year, and that he supports higher deposit insurance to protect small banks’ competitiveness against larger institutions. (Politico Pro, Feb. 4)

- He also supported HFSC Chairman French Hill’s (R-AR) community banking legislative package. He emphasized that small and community banks need tailored capital and risk standards to succeed. (American Banker, Feb. 4)

- Democratic lawmakers warned that easing regulatory scrutiny could increase systemic risk and repeat conditions that preceded the 2008 financial crisis, with HFSC Ranking Member Maxine Waters (D-CA) arguing that FSOC should play a stronger role in identifying risks across the financial system, including among nonbank entities. (Watch Hearing)

Affordability and Tariffs

- During the HFSC hearing, Ranking Member Waters pressed Sec. Bessent on whether the administration’s tariffs have contributed to persistent inflation. Sec. Bessent rejected that characterization and disputed claims that he had previously warned investors tariffs were inflationary. (American Banker, Feb. 4)

- Ranking Member Waters also linked tariffs directly to worsening housing affordability, pointing to duties on key construction inputs such as lumber, steel, and appliances. (American Banker, Feb. 4)

- While Democrats argued that tariffs and high prices continue to burden consumers, Sec. Bessent cited a Wharton study that points to immigration-driven demand as a contributing factor to higher housing costs. (CNBC, Feb. 4)

Roundtable Advocacy

- The Real Estate Roundtable (RER) and coalition partners have supported the Financial Stability Oversight Council Improvement Act (H.R.3682), which would require FSOC to consult with a company and its primary regulator before designating a nonbank as a SIFI. (Letter, Oct. 28)

- The bill is intended to strengthen due-process protections, improve interagency coordination, and ensure designations are based on rigorous analysis.

- RER has consistently urged regulators to focus on activities that pose genuine systemic risk, rather than imposing broad designations that can create regulatory overreach and unintended consequences for credit markets. (Roundtable Weekly, Oct. 31)

CRE’s Reaction to Fed Chair Nomination

- Last week, President Donald Trump announced his nomination of Kevin Warsh, a former Federal Reserve Governor, to succeed Fed Chair Jerome Powell. (Axios, Jan. 30)

- As industry media outlets have reported, commercial real estate and finance leaders have broadly welcomed the nomination, citing Warsh’s experience from the financial crisis and his capital markets expertise. (Bisnow, Jan. 30)

- “Kevin Warsh is a smart, thoughtful, and experienced nominee. His deep understanding of monetary policy and financial markets would help maintain and strengthen market confidence at a time when economic certainty matters most,” Jeffrey D. DeBoer, RER President and CEO, said.

- Bob Broeksmit, President and CEO of the Mortgage Bankers Association, said in a statement that Warsh’s prior service on the Fed board gave him a reputation as “a prudent, thoughtful voice on monetary policy.”(ConnectCRE, Jan. 30)

- CRE finance experts noted that while Warsh’s nomination could raise expectations for near-term rate cuts, uncertainty surrounding the confirmation process and Fed independence may keep long-term Treasury yields, as well as permanent financing costs, elevated. (ConnectCRE, Jan. 30)

RER remains committed to engaging policymakers on FSOC reform and related financial regulations to ensure oversight frameworks support capital formation, liquidity, and economic growth.