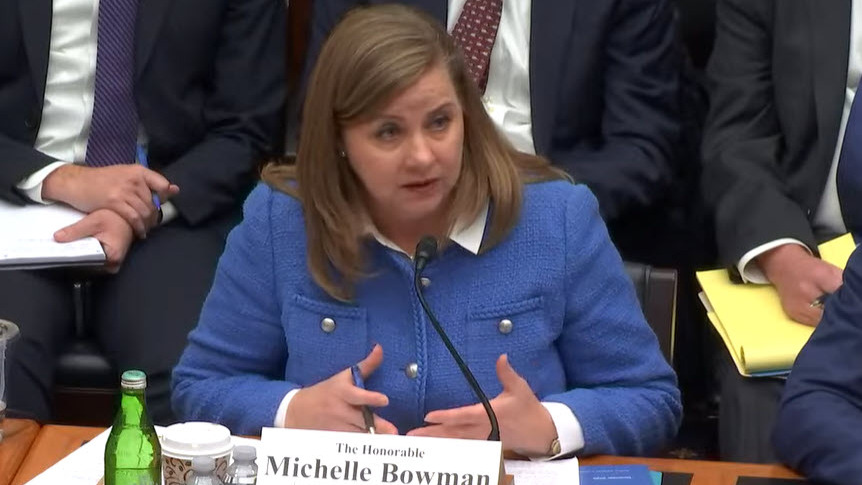

The Federal Reserve is moving to recalibrate key elements of the U.S. bank capital and liquidity framework, including Basel III Endgame implementation and targeted mortgage-capital adjustments. The Fed’s Vice Chair for Supervision, Michelle Bowman, signaled this week that reforms should support market liquidity and credit availability while maintaining safety and soundness. (FinancialTimes, Feb. 16)

State of Play

- Bowman told bankers at the ABA’s 2026 Conference for Community Bankers this week that the Fed will soon seek comment on two proposals to encourage banks to re-engage in mortgage origination and servicing, within the Basel framework. (Speech, Feb. 16)

- Bowman pointed to a “concerning trend” of mortgage activity to nonbanks. She cited data showing banks originated roughly 60% of mortgages in 2008 and serviced roughly 95% of outstanding balances; by 2023, those figures had fallen to about 35% and about 45%, respectively. (HousingWire, Feb.16).

- The mortgage capital discussion comes as the Trump administration seeks tools to bolster affordability and credit availability, including directing Fannie Mae and Freddie Mac to purchase $200 billion in mortgage-backed securities. (Reuters, Feb. 18)

- “By creating a resilient mortgage market that includes robust participation from all types of financial institutions, we can deliver affordable credit and high-quality servicing to borrowers regardless of economic conditions,” Bowman said. (Speech, Feb. 16)

- Bowman said the shift has implications for the banking industry, mortgage market stability, and consumers.

Basel III Endgame

- In separate remarks on Feb. 19, Bowman said regulators are modernizing the “four pillars” of the capital framework—stress testing, supplementary leverage ratio (SLR), Basel III Endgame, and the G-SIB surcharge—with a focus on market liquidity and affordable homeownership alongside safety and soundness. (Speech, Feb. 19)

- Bowman said the Basel effort is “bottom-up,” not “reverse engineered,” arguing that finalizing Basel III would reduce uncertainty and provide clarity for bank capital standards. (PoliticoPro, Feb. 19)

- The Federal Deposit Insurance Corporation (FDIC) and the Office of the Comptroller of the Currency (OCC) recently submitted their Basel-related proposals to the Office of Management and Budget (OMB) for review—an important step in the interagency process. (Reuters, Feb. 13)

- The Trump administration regulators have said they plan to rewrite liquidity rules, though details have not been released. (PoliticoPro, Feb. 19)

- Bowman’s recent remarks are the clearest signal yet of how the Fed may recalibrate the U.S. approach to Basel capital implementation, following industry concerns that earlier proposals could constrain credit and further shift activity to less-regulated lenders.

Roundtable Advocacy

- In December, RER and a coalition of leading business trade organizations urged prudential regulators to examine and modernize large bank capital requirements so they continue supporting consumers, businesses, and the broader U.S. economy. (Letter, Dec. 2)

- The coalition letter underscored the negative economic impacts of inappropriately calibrated capital rules, highlighted risks to American competitiveness, and commended ongoing agency efforts to improve the framework. (Roundtable Weekly, Dec. 5)

What’s Next

- The Fed is expected to issue the mortgage-capital proposals for public comment before any changes take effect, while agencies continue advancing a revised Basel III Endgame package.

- Bowman is expected to testify next Thursday alongside the heads of the OCC, the FDIC, and the National Credit Union Administration at a Senate oversight hearing. (WSJ, Feb. 19)

As regulators advance both targeted mortgage capital adjustments and a revised Basel III Endgame proposal, RER will remain engaged to ensure capital reforms do not constrain credit flows essential to commercial real estate, economic activity, and long-term investment, while protecting safety and soundness.