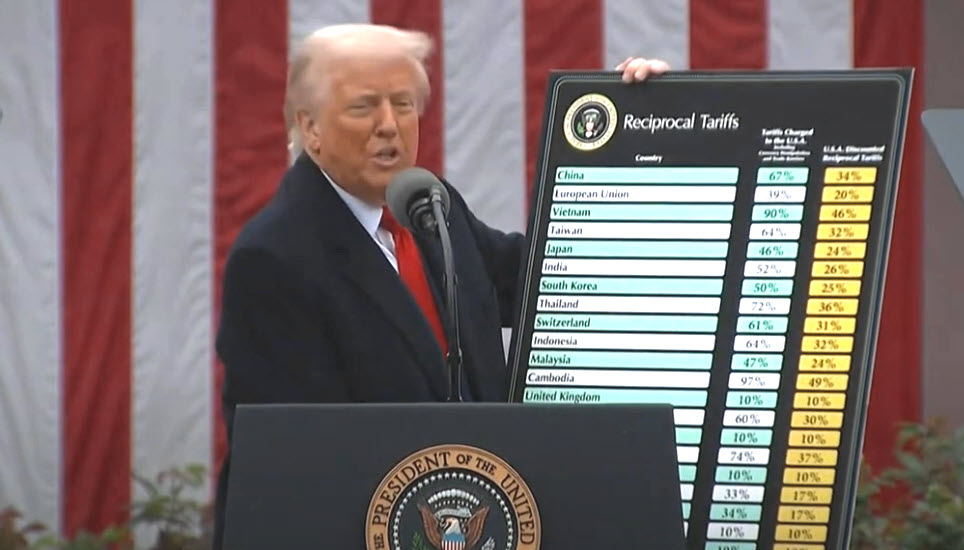

This week saw a major announcement from President Trump on sweeping new tariffs and movement in Congress as the Senate advances a compromise budget resolution, with big implications for tax and spending cuts.

Budget Resolution Moves Forward

- During his tariff announcement, President Trump announced his “complete and total support” for a compromise budget resolution released on Wednesday. The statement came after Senate Budget Committee Chair Lindsey Graham (R-SC) unveiled the updated resolution, paving the way for a vote later this week. (Punchbowl News, April 3)

- Trump’s public support for the budget resolution was the result of behind-the-scenes negotiations with Senate leadership to move the reconciliation process forward.

- Senate Majority Leader John Thune (R-SD) and others in the administration brought the meeting together to alleviate the concerns of skeptical deficit hawks who believed the Senate’s budget resolution didn’t do enough to cut spending. (Punchbowl News, April 3)

- After receiving assurances from Trump about his support for large-scale deficit reductions, Senators John Kennedy (R-LA) and Ron Johnson (R-WI) seemed to get on board with the compromise budget resolution. With key holdouts resolved, Majority Leader Thune appears to have the votes needed to get the resolution adopted. (CNN, April 2)

- The budget resolution includes separate spending cut instructions for the House and Senate. While House committees are instructed to find $1.5 trillion in spending cuts, the Senate instructions only call for $4 billion. Senate GOP leaders indicate that they still plan to target $1.5 to $2 trillion in spending cuts, giving them greater flexibility but punting lingering issues down the road. (Politico, April 3)

- A “vote-a-rama” on the budget resolution is expected to begin Friday evening, with final adoption anticipated early Saturday. (Politico, April 2)

Tax Policy Implications

- The compromise budget resolution incorporates a “current policy baseline” approach that allows the 2017 tax cuts to be permanently extended without needing to offset roughly $4 trillion in costs.

- The Senate version also authorizes $1.5 trillion in additional tax relief beyond making the tax cuts permanent, allowing tax writers to include other key provisions that business advocates are asking for.

- The current policy baseline was another sticking point in the Senate resolution that has been punted to later in the process. Senate GOP leadership has opted to assert that the Budget Committee Chair has the authority to choose the baseline used in reconciliation. (Axios, April 1)

- While this decision allows the compromise budget resolution to move forward, the parliamentarian could still rule on the issue later on. If the parliamentarian rules against the current policy baseline, it would dramatically change the budget resolution landscape and potentially force the GOP to enact a shorter-term extension of the 2017 tax cuts, rather than making them permanent.

- The current policy baseline also has political implications. Responding to the Senate resolution, House Budget Committee Chair Jodey Arrington (R-TX) and other House tax writers expressed concern that the Senate budget resolution could add as much as $5.3 trillion to the debt. (Politico, April 2)

- House Speaker Mike Johnson (R-LA) was more optimistic about the compromise budget resolution and the inclusion of the current policy baseline, saying, “We’re in the consensus-building business here… So we’ll have to socialize this with our members and see. Look, I think there’s a large number of House Republicans who expected that would be the final outcome… so it’s not a big surprise.” (Punchbowl News, April 3)

- In a conversation with Punchbowl News this week, Chairman of the House Financial Services Committee French Hill (R-AR) emphasized that President Trump and House and Senate GOP leaders are united on the urgency to get the reconciliation package done.

- Rep. Hill also strongly defended the current tax treatment of carried interest. “It’s not a loophole,” he said, calling it an “important component for long-term finance across the country” for many businesses, including commercial real estate, venture capital and energy. (Punchbowl News, April 3)

Looking Ahead

The coming weeks are a critical time for the administration and congressional leaders on key issues, including trade and tax policy. RER will continue to engage with policymakers to advocate for pro-growth policies that support investment, job creation and healthy real estate markets.