After months of high-stakes negotiations, Congress this week passed the sweeping One Big Beautiful Bill Act, a comprehensive reconciliation package that overhauls tax policy, restructures federal spending, and advances numerous Real Estate Roundtable (RER) priorities as it heads to President Trump’s desk for signature. (Roll Call, July 3)

State of Play

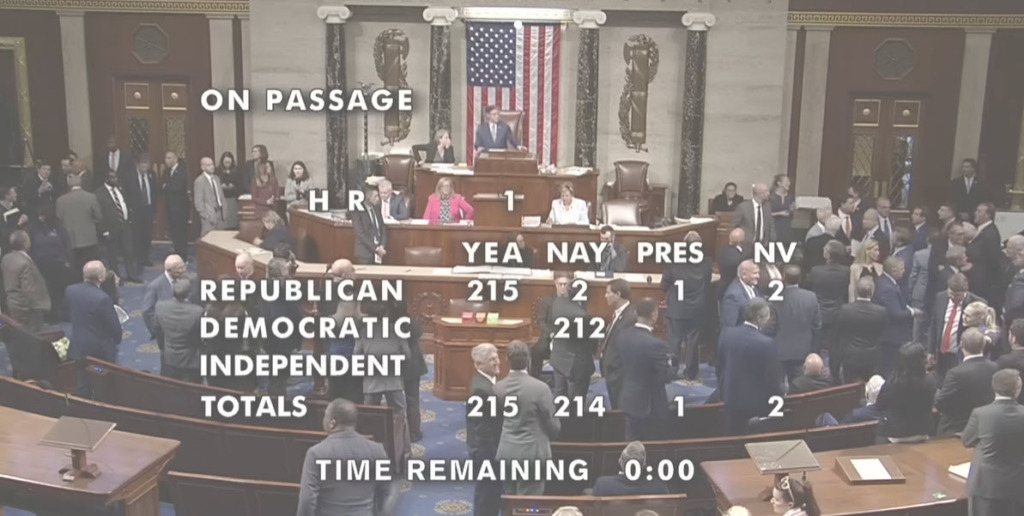

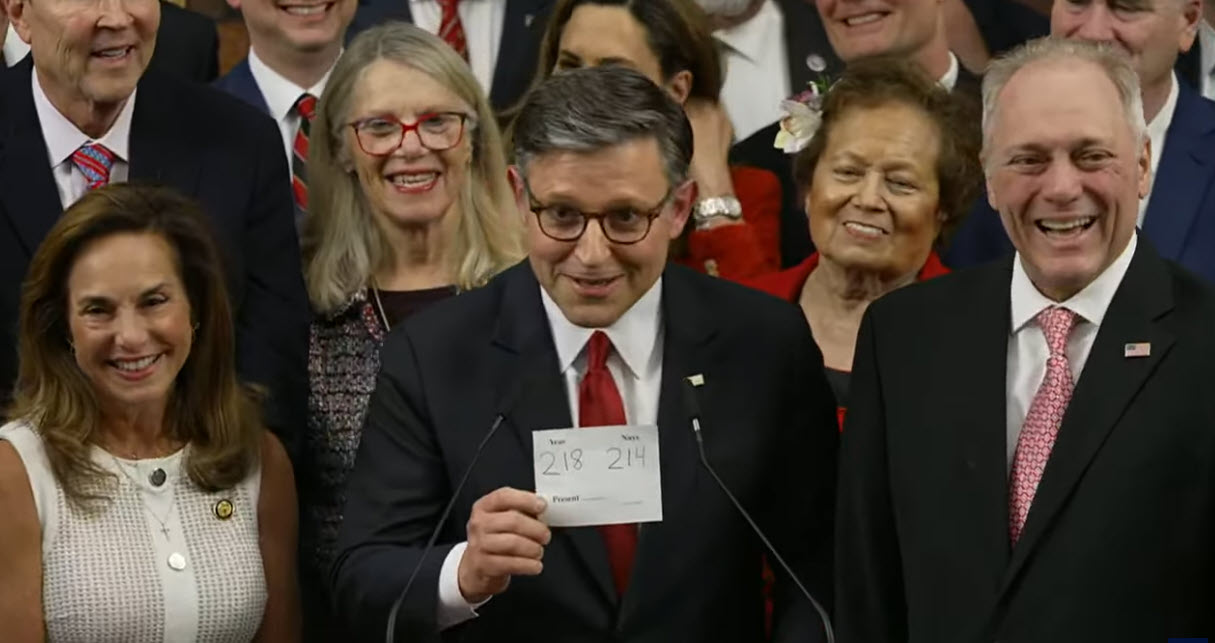

- The House passed the final version of the One Big Beautiful Bill Act this afternoon, following a narrow vote of 218–214, capping off weeks of negotiations and delivering a legislative victory to Republican leaders ahead of the July 4 deadline. In the end, two Republicans—Reps. Thomas Massie (R-KY) and Brian Fitzpatrick (R-PA)—joined all Democrats in opposing the bill. (The Hill, July 3)

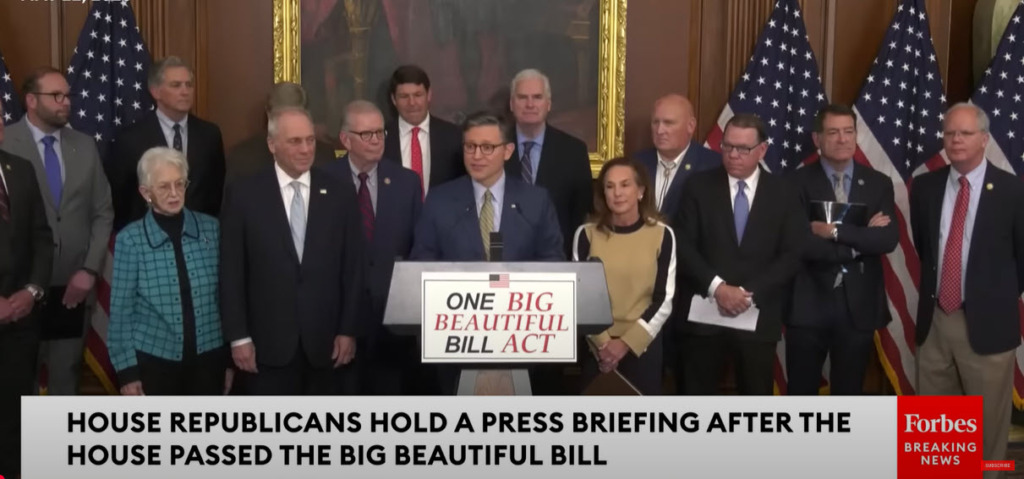

- “With one big, beautiful bill, we are gonna make this country stronger, safer, and more prosperous than ever before, and every American is going to benefit from that,” said House Speaker Mike Johnson (R-LA). “Today we are laying a key cornerstone of America’s new golden age.” (Politico, July 3)

- The Senate passed the sweeping budget bill in a 51-50 vote on Tuesday, after almost 24 hours of debate, amendments, and a “vote-a-rama” that ended with Vice President JD Vance casting the tiebreaking vote in favor of passage. Three GOP senators—Rand Paul (R-KY), Thom Tillis (R-NC), and Susan Collins (R-ME) voted no. (Axios, July 2)

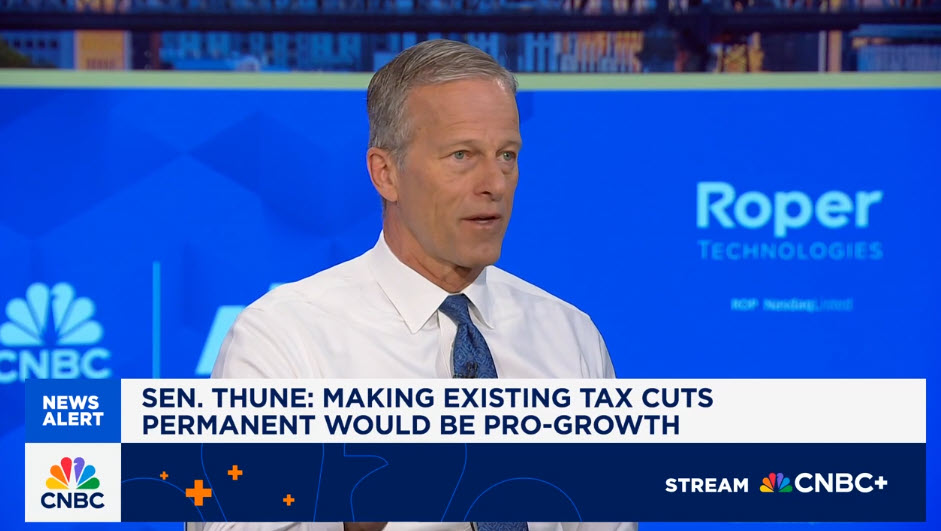

- In an interview after the bill’s Senate passage, Senate Majority Leader John Thune (R-SD) acknowledged that the decision to make the measure’s business tax cuts permanent impacted its savings and overall strategy. “We really believed that permanence was the key to economic growth because it creates certainty,” he said. “All the models that we saw showed that you got more growth with permanence.” (PoliticoPro, July 1)

Roundtable Advocacy

- The final legislation advances a broad array of policies that support capital formation, real estate investment, and housing development, while repealing harmful proposals like Section 899 and preserving longstanding tax rules vital to CRE.

- “This legislation represents a meaningful step toward strengthening communities, expanding housing opportunities, and supporting long-term economic growth,” said Jeffrey DeBoer, President and CEO of RER. “By advancing policies that encourage investment and preserve small business tax parity, Congress is helping to revitalize neighborhoods, create jobs, and ensure all Americans benefit from a stronger built environment.

- DeBoer added, “We are, of course, disappointed that the overall bill is predicted to increase the deficit and national long-term debt. However, we hope that the pro-growth aspects of the bill will narrow both by significantly growing the economy and providing revenues greater than those now projected. Likewise, we are concerned with predictions by some regarding the impact of spending cuts on research and needed health care for Americans.”

- RER’s advocacy efforts were particularly successful in eliminating several provisions that would have severely impacted CRE, including Section 899, known as the “revenge tax,” and harmful limitations on state and local tax deductions for pass-through businesses.

- Speaking to Bisnow regarding the impact of the tax provisions on real estate, Ryan McCormick, RER’s SVP and Counsel, said, “From the bill’s investment in housing and low-income communities to its fair treatment of entrepreneurial and pass-through businesses, the legislation strikes the right balance … it should spur job-creating capital investments in commercial properties across the nation.” (BisNow, July 1)

Tax Policy

- The final legislation includes several tax provisions that will provide significant benefits to commercial real estate and support long-term economic growth:

- Permanent Business Tax Cuts: The bill makes permanent several business tax deductions from the 2017 Tax Cuts and Jobs Act (TCJA), including the Section 199A deduction for pass-through businesses and interest deductibility rules under Section 163(j).

- Section 899: Late last week, lawmakers removed the Section 899 provision known as the “revenge tax” from the bill after the Treasury Department secured an international tax agreement with G7 countries. RER strongly advocated for changes to the measure, warning that the tax would have deterred foreign investment in U.S. commercial real estate and weakened capital formation. (Roundtable Weekly, June 27) (BisNow, July 1) (Commercial Property Executive, July 1)

- Opportunity Zones: OZs are now a permanent feature of the tax code, though deferral periods for eligible gains are shortened through the end of 2026—a technical issue that RER will continue to address in discussions with Congress and Treasury.

- Low-Income Housing Tax Credit (LIHTC): The bill preserves and enhances the LIHTC program, supporting the construction of affordable housing nationwide.

- Bonus depreciation & expensing: Full expensing and 100% bonus depreciation for qualifying property are restored and made permanent, providing significant cash flow benefits for property owners undertaking capital improvements.

- SALT workarounds preserved: The final bill drops proposed changes to state and local tax deductibility on pass-through business income, preserving current law that allows deductibility through state pass-through entity tax regimes.

- Condominium construction tax accounting: The legislation includes provisions the RER has advocated for since 2015, allowing condo developers to use the completed contract method of accounting, aligning tax liability with actual receipts.

- Excess business losses: The revised Senate bill avoids a controversial proposal from earlier drafts that would have permanently siloed active pass-through business losses, instead opting to extend current law under Section 461(l) without restricting taxpayers from using those losses against wages and investment income. This approach preserves flexibility for entrepreneurs, start-ups, and two-earner households and avoids undermining the principle of measuring true net income.

Energy Tax Credits

- For months, clean energy tax incentives enacted under the Inflation Reduction Act (IRA) have been a point of contention in both the House and Senate, with several Republican lawmakers urging leadership to take a more targeted approach to scaling back the IRA’s provisions—while maintaining incentives that support both traditional and renewable energy sectors. (RW, April 25) (CBS News, July 1)

- Ultimately, the final legislation significantly scales back the IRA’s clean energy tax incentives by accelerating the phase-out of wind and solar credits, while dropping a controversial excise tax on projects using foreign components and preserving eligibility for already planned or approved developments that begin construction before mid-2026. (PoliticoPro, July 1) (Bloomberg, July 1)

- The Section 48E Investment Tax Credit (ITC) for wind and solar projects remains in the tax code, but projects that begin construction 12 months after the bill’s enactment must be placed in service by the end of 2027.

- The Section 179D deduction for energy-efficient commercial building construction and retrofits is now limited to projects that begin construction by June 30, 2026.

- Similarly, the 45L tax credit for energy-efficient new residential construction expires for homes “acquired” after June 30, 2026.

- Importantly, ENERGY STAR’s current budget for FY2025 was not affected by any of the funding rescissions in the final bill.

- At this week’s BOMA International Conference, RER’s SVP and Counsel Duane Desiderio joined John Boling (VP, Advocacy & Building Codes, BOMA International) for a panel discussion on ENERGY STAR Portfolio Manager, highlighting the program’s legal foundation, bipartisan economic appeal, and importance to real estate stakeholders. (Commercial Property Executive, July 2)

- RER will continue engaging with lawmakers through the annual appropriations process to ensure that FY2026 federal funding bills (for spending starting October 1) support ENERGY STAR. (Commercial Property Executive, July 2)

What’s Next

- With the One Big Beautiful Bill Act heading to the president’s desk, attention now turns to the appropriations process and additional reconciliation opportunities.

- Speaker Mike Johnson has expressed interest in pursuing additional budget reconciliation efforts, a process that Congress can undertake at the end of the fiscal year.

- In an interview on Fox News Tuesday, Johnson said, “This is just a step in a sequence of events. We’re intending to do more reconciliation work. The plan is to do one in the fall for FY26 budget year and we can also squeeze in a third one for FY27 before this Congress is up.” (Politico, July 2) (Punchbowl News, July 2)

RER will continue to provide in-depth analysis in the coming days and weeks on the reconciliation bill’s implications for commercial real estate, including technical implementation, market impacts, and policy recommendations.