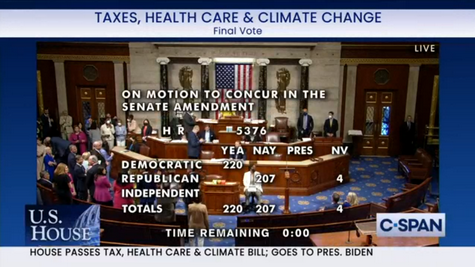

The Inflation Reduction Act of 2022 (IRA) heads to President Joe Biden’s desk for his signature, following passage by the House today and the Senate on Sunday. After weeks of negotiations, the comprehensive economic package primarily brokered by Senate Majority Leader Chuck Schumer (D-NY) and Senator Joe Manchin (D-WV) reflects Democratic priorities to combat climate change, reduce prescription drug costs, and lower the deficit by roughly $300 billion over the next decade. (Washington Post, Aug. 7; Roundtable Weekly, July 29)

Why It Matters

- After Congress passed the IRA today, President Biden stated, “With the passage of the Inflation Reduction Act in the House, families will see lower prescription drug prices, lower health care costs, and lower energy costs. I look forward to signing it into law next week” (Twitter, Aug. 12 | Wall Street Journal, Aug. 12)

- The $790 billion reconciliation proposal includes nearly $370 billion in climate spending that affects “clean energy” measures important to commercial real estate, the largest federal clean energy investment in U.S. history. (NPR, Aug. 7) (see story below)

CRE Impact

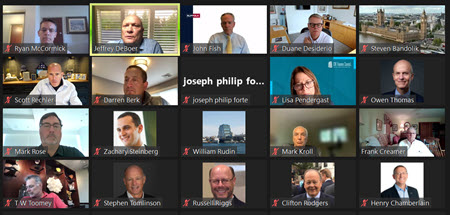

Real Estate Roundtable President and CEO Jeffrey DeBoer commented today, “The revised Inflation Reduction Act is a welcome step toward boosting economic growth by spurring extensive investments in clean energy and climate measures that benefit both our industry and our country. We applaud Congress for recognizing and protecting the critical role of carried interest provisions in incentivizing the risk-taking necessary for robust economic development. We look forward to working with our partners in industry and government to implement this legislation.”

- Proposed changes to the taxation of carried interest were cut from the IRA last week at the request of Sen. Kyrsten Sinema (D-AZ). The Roundtable and 14 other national real estate organizations wrote to all members of Congress on Aug. 3 in strong opposition to the measure. (Coalition letter, Aug. 3 | Roundtable Weekly, Aug. 5 )

- The IRA’s largest tax increase is a 15% corporate minimum tax on businesses with profits over $1 billion whose reported book income exceeds reported taxable income. The measure is estimated to raise $313 billion.

- The final bill includes a 1 percent tax on what public companies spend on stock buybacks. However, it did not include any changes to the state and local tax (SALT) deduction. (CQ, Aug. 7)

- The package also includes protections that would preserve the value of the low-income housing tax credit for investors (typically large banks) that use the credit to reduce their effective tax rate.

In the coming weeks, The Roundtable will continue updating summaries of the tax and energy provisions in the IRA while also analyzing the direct and indirect impact on commercial real estate. (See below for Clean Energy Tax Incentives Fact Sheet)

# # #