As Congress works to meet a July 4 deadline for sweeping reconciliation legislation, The Real Estate Roundtable (RER) and partner organizations are calling on Senate leaders to align with House-passed tax measures that strengthen Main Street businesses by expanding the Section 199A deduction, protecting the Opportunity Zones program, and advancing a lower capital gains rate to drive long-term investment.

Section 199A

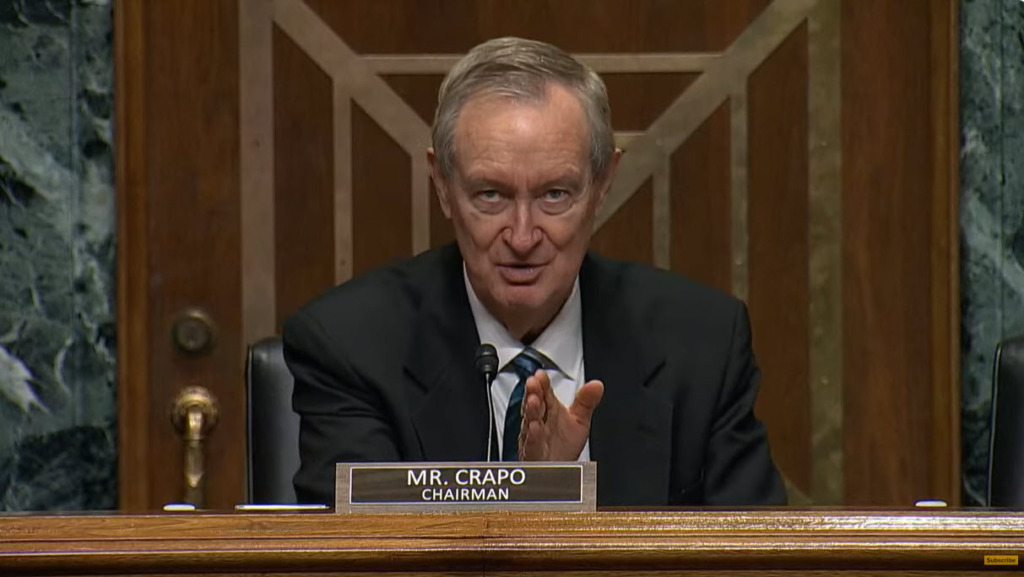

- RER and nearly 100 other organizations sent a letter to Senate Finance Committee Chair Mike Crapo (R-ID), calling for the Senate to follow the House’s lead in expanding the Section 199A deduction from 20% to 23%. (PoliticoPro, June 26)

- The Senate version originally would have made the deduction permanent but limited SALT deductibility, resulting in higher effective tax rates for many pass-throughs. But in a positive development announced today by Punchbowl News, Senate Republicans plan to entirely drop those new limits as part of a pending deal with the House GOP.

- The House approach would maintain tax parity with C corporations and help ensure that small businesses—including real estate partnerships—can continue to invest, grow, and hire.

- “Expanding Section 199A will help preserve tax parity between pass-through businesses and larger public corporations while helping ensure the Senate bill does not raise taxes on millions of Main Street businesses,” the coalition wrote. (Letter, June 25 )

Opportunity Zones

- Using the “current policy baseline,” the Opportunity Zone program is now projected to generate $66 billion in savings rather than costing $7.5 billion under traditional estimates, making it appear as a revenue raiser rather than a tax cut. (PoliticoPro, June 27)

- Senate Budget Committee Chair Lindsey Graham (R-SC) said, “We need a current policy baseline to make tax cuts permanent, and we need Opportunity Zones to help urban and rural poor areas, so we’ll just press on — no matter what.”

Capital Gains Bill Introduced

- Reps. French Hill (R-AR) and Greg Steube (R-FL) introduced the Revitalizing Investment, Savings, and Entrepreneurship (RISE) Act to lower the top federal capital gains rate to 15%, aiming to boost investment and long-term economic growth. (Rep. Hill Press Release, June 24)

- The RISE Act would restore a bipartisan policy that was in place from 2003 to 2012.

- “To build a stronger, more prosperous future, we need policies that unlock capital, reward risk-taking, and drive real growth for all Americans. That is exactly what the RISE Act delivers,” said Rep. Hill.

As negotiations continue, RER remains focused on advancing tax policies that foster capital formation, protect real estate investment, and support Main Street employers nationwide.

Legislation aimed at increasing the nation’s supply of affordable housing was introduced by Senate and House tax writers this week while the National Multifamily Housing Council (NMHC) and National Apartment Association (NAA) offered joint testimony before a March 7 Senate Finance Committee hearing on “

Legislation aimed at increasing the nation’s supply of affordable housing was introduced by Senate and House tax writers this week while the National Multifamily Housing Council (NMHC) and National Apartment Association (NAA) offered joint testimony before a March 7 Senate Finance Committee hearing on “