The Real Estate Roundtable (RER) submitted a comment letter this week urging the Treasury Department and IRS to finalize proposed regulations (REG-109742-25) that would repeal the Foreign Investment in Real Property Tax Act (FIRPTA) “look-through” rule for domestically controlled real estate investment trusts (REITs). (Letter, Dec. 5)

RER Advocacy

- In October, Treasury and IRS issued a Notice of Proposed Rulemaking to repeal the FIRPTA “look-through” rule, a major policy shift advocated by RER, which has opposed the rule since it was first proposed in 2022. (Roundtable Weekly, Oct. 24)

- In 2024, in an act of broad regulatory overreach, Treasury finalized a new look-through rule to determine whether an entity qualifies as domestically controlled for FIRPTA purposes. The practical effect was to subject a significant share of previously tax-exempt foreign investment in U.S. real estate to U.S. capital gains tax. The rule was finalized with only modest transition relief.

- In March, RER submitted a letter to the new administration outlining concerns with the regulation and urging its withdrawal on the grounds that the look-through rule reversed decades of well-settled tax law, severely misconstrued the statute, and contradicted congressional intent. (Roundtable Weekly, March 21)

- The positive development reflects years of coordinated engagement from RER and TPAC members on the issue. Comments submitted by RER in 2023, not long after the regulations were first proposed, also advocated repeal of the look-through rule. RER’s March 2025 submission was its fourth letter to Treasury and Congress on the matter. (Letters, July 2024; Feb. 2023; Mar. 2023) (Roundtable Weekly, July 2024)

- Treasury’s proposed rule would restore prior law by treating domestic C corporations as non-look-through entities, removing a regulatory barrier that has discouraged foreign investment in U.S. real estate and infrastructure.

- This week’s letter highlighted the importance of foreign capital to U.S. construction, development, and housing production. In recent years, foreign investors have committed more than $40 billion to U.S. multifamily housing, financing new development, supporting construction jobs, and helping expand housing supply nationwide. (Letter, Dec. 5)

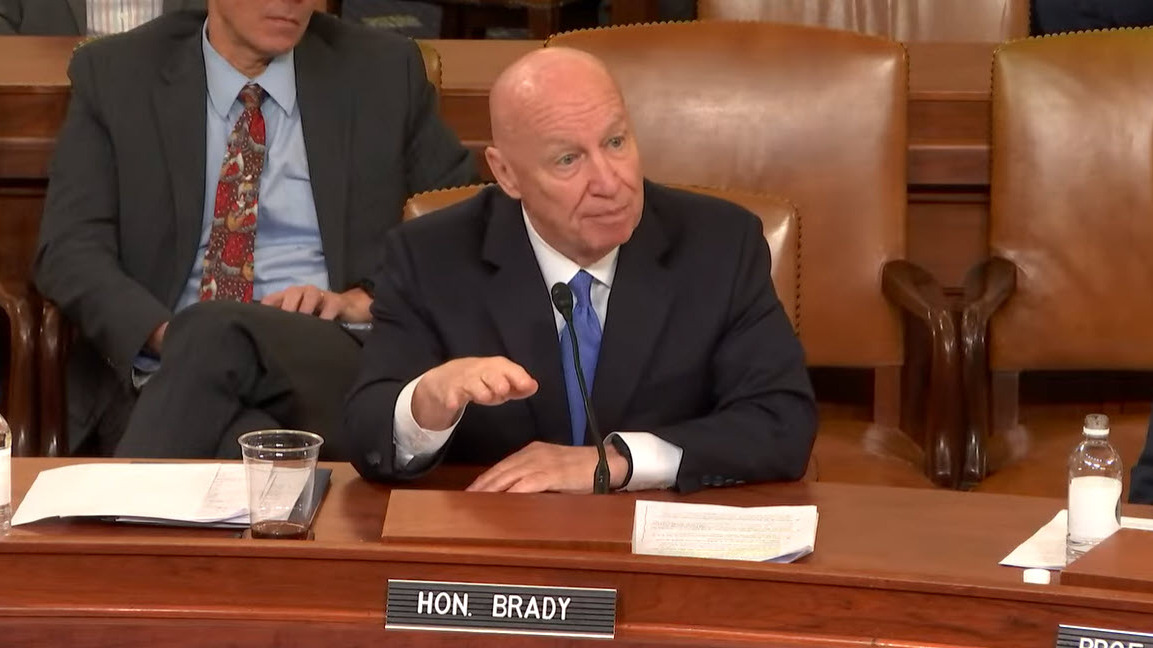

House Ways & Means Hearing – International Tax

- The House Ways and Means Subcommittee on Tax held a hearing on Wednesday, “Promoting Global Competitiveness for American Workers and Businesses,” focused on how international tax policy affects U.S. competitiveness, investment, job creation, and economic growth. (Watch Hearing)

- Former Ways and Means Chairman Kevin Brady testified that post One Big Beautiful Bill Act Treasury guidance can provide critical certainty and stability, adding that Treasury appears eager, as in 2017, to implement Congress’s intent in writing the law. (Brady Testimony)

- Members also discussed the Organization of Economic Co-Operation and Development (OECD) global minimum tax framework and the unresolved “side-by-side” agreement intended to shield U.S. companies from Pillar Two taxes.

- House Ways and Means Chairman Jason Smith (R-MO) renewed his warning that Congress is prepared to reconsider retaliatory measures, including Section 899, if other nations fail to honor commitments to exempt the U.S. from the OECD global minimum tax framework.

- Chairman Smith (R-MO) said, “The time for action is now for those G7 countries. We expect to see the technical work that has been done in these negotiations move forward this week.” (PoliticoPro, Dec. 4)

RER and other industry groups have warned that reviving Section 899 could negatively impact U.S. commercial real estate by deterring foreign investment, weakening capital formation, increasing borrowing costs, and dampening property values.