The U.S. Department of the Treasury is revising its proposed Section 892 regulations after the investment and real estate industries raised concerns that aspects of the framework could raise their cost of capital by deterring passive investment by foreign governments, including sovereign wealth funds.

State of Play

- A Treasury Department spokesperson told Bloomberg Law the agency is “revising the proposal to address key issues and ensure it supports stable, long-term capital flows,” citing feedback from the investment and real estate industry, including The Real Estate Roundtable (RER). (Bloomberg Law, Feb. 20)

- The proposed Section 892 regulations (REG-101952-24) address two critical questions that can trigger U.S. tax liability: when a foreign government has effective control of an entity engaged in commercial activities, and when an acquisition of debt by a foreign government is considered to be commercial activity.

- Treasury tax policy officials also indicated the proposed regulations—if finalized—will not be applied retroactively to existing transactions and structures. (Tax Notes, Feb. 23)

RER Advocacy

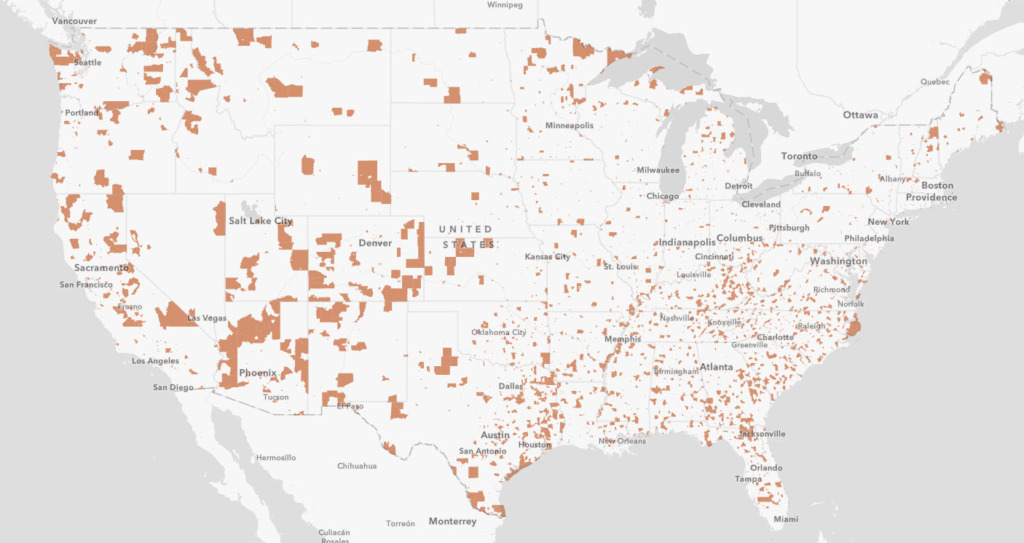

- Earlier this month, RER submitted a comment letter to Treasury Secretary Scott Bessent on the Section 892 final and proposed rules, urging clear grandfathering rules and changes to prevent disruptions to sovereign investment in U.S. real estate. (Letter, Feb. 12)

- The letter recommended targeted fixes, including clarifying that customary minority protections do not create effective control; confirming that withholding agents may rely on foreign government self-certifications; and adding safe harbors (including for certain distressed-debt modifications).

- RER’s recommendations would ensure U.S. real estate owners and developers can continue to mobilize capital from foreign government sources while preserving Section 892’s fundamental distinction between tax-exempt investment activities and taxable commercial activities. (Roundtable Weekly, Feb. 13)

RER’s Tax Policy Advisory Committee (TPAC) Advocacy

- The letter was developed by TPAC’s Section 892 Working Group, which includes representatives from a diverse group of foreign investors, U.S. real estate sponsors, and outside advisors.The principal drafter was TPAC member and Skadden partner Nickolas Gianou.

RER will continue engaging Treasury to ensure the final Section 892 regulations do not discourage sovereign capital that supports U.S. real estate investment and jobs.