As the Federal Reserve’s latest Beige Book reveals, the U.S. economy is continuing to adjust to shifting conditions, with commercial real estate leaders focusing on strategies to navigate ongoing uncertainty and emerging opportunities. (The Fed, June 4)

Beige Book Findings

- The Beige Book published this week, reported that “all Districts reported elevated levels of economic and policy uncertainty, which have led to hesitancy and a cautious approach to business and household decisions.”

- The report, based on surveys and interviews conducted through May 23, noted that the overall outlook remains “slightly pessimistic and uncertain,” unchanged from the prior report. (Bloomberg, June 4)

- Nine of the 12 Federal Reserve districts reported either a contraction in economic activity or no change in growth; only a few districts, including Richmond, Atlanta, and Chicago, experienced modest growth. (Market Watch, June 4)

- Commercial construction and real estate activity also declined overall, with the office sector continuing to lag. In San Francisco, construction activity remained subdued due to uncertainty over trade policy and rising material costs. (The Fed, June 4)

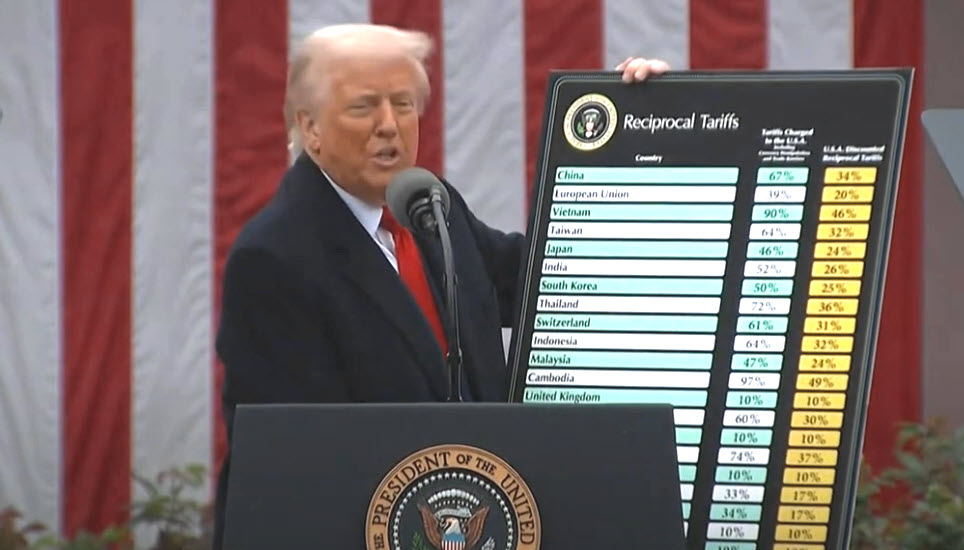

- Tariffs were mentioned 122 times in the report, compared to 107 times in April, reflecting rising concerns about inflationary pressures. (CNBC, June 4)

- In Boston, the Fed noted deals took longer to close, and “foreign investors grew generally skittish about investing in the United States.”

Economic Conditions & CRE

- This week, during Lument’s webcast, “Turning Point: Multifamily Strategies Amidst Policy and Economic Shifts,” RER’s President & CEO Jeffrey DeBoer discussed how federal policies, including tariffs, liquidity, and the ongoing tax debates in Washington, are reshaping investor strategies.

- DeBoer also emphasized that uncertainty and volatility are hindering investment decisions, mirroring the Beige Book’s findings of delayed business spending.

- RER’s Q2 Sentiment Survey reflected similar caution, with the index falling to 54 as executives cited policy uncertainty, rising costs, and muted investor confidence—echoing the Beige Book’s insights on slowing activity and elevated economic risk. (Roundtable Weekly, May 23)

- On Wednesday, the administration doubled tariffs on steel and aluminum imports from 25% to 50%, adding further pressure on construction costs and heightening unpredictability. (BisNow, June 4)

- In the May edition of ULI’s Economist Snapshot, RER’s Senior Vice President Clifton E. “Chip” Rodgers Jr. weighed in on how rising tariffs and trade tensions are impacting U.S. commercial real estate—from delayed development timelines to increasing construction costs and reduced foreign investment. (ULI, May 13)

What’s Next

The Fed will consider the Beige Book findings at its June 17–18 meeting as it navigates a delicate balancing act between persistent inflation risks and ongoing trade tensions.