President Donald Trump’s second term is rapidly taking shape, with sweeping executive orders, quick nominations and bold policy announcements advancing in the first few days of his second administration. From tax policy to housing, immigration, and energy initiatives, the commercial real estate sector faces a dynamic and fast-changing landscape.

Tax Policy

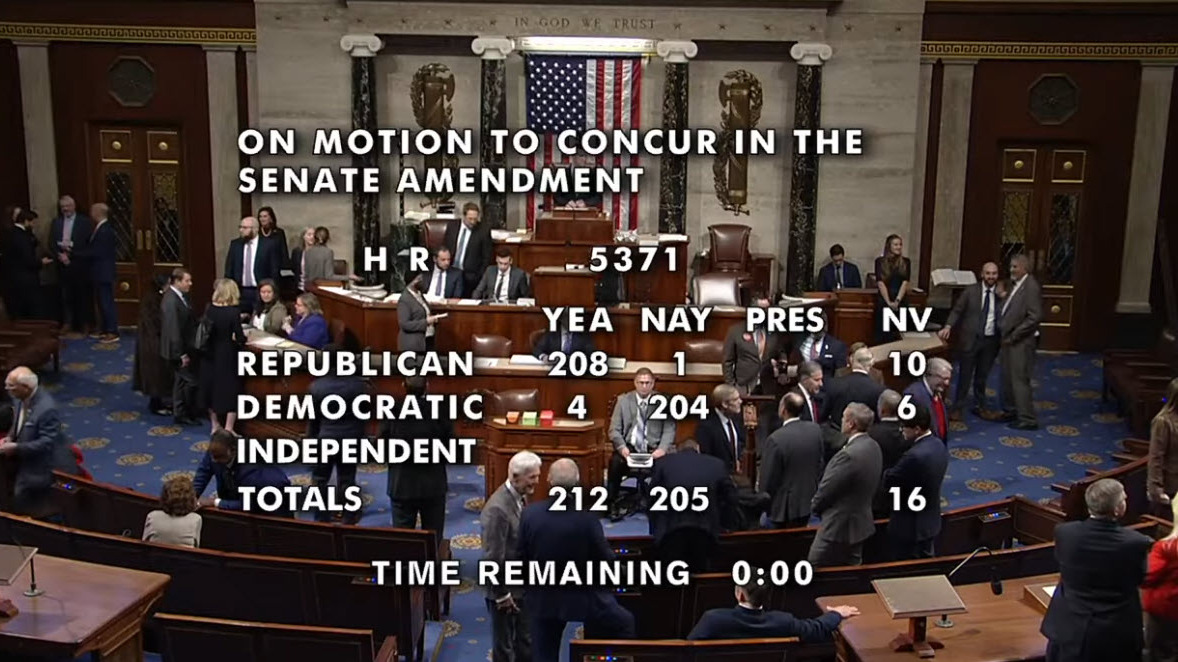

- TCJA Renewal: Efforts to extend key provisions of the 2017 Tax Cuts and Jobs Act (TCJA) are a key priority for the Trump administration and Republicans in Congress, with significant implications for commercial real estate.

- A number of RER priorities are at stake, including maintaining the reduced tax rate on capital gains, extending Opportunity Zones and the Section 199A deduction, safeguarding like-kind exchanges and enacting federal tax incentives for property conversions to address the housing shortage. (Roundtable Weekly, Jan. 10)

- The content of the reconciliation package continues to be heavily debated, with multiple areas of intra-party disagreement among Republicans to overcome in order to reach a deal. Concerns about pay-fors, the growing debt, budget cuts and proposals to eliminate the state and local tax deduction (SALT) remain. (Politico, Jan. 22)

- RER President & CEO Jeffrey DeBoer appeared on Marcus & Millichap’s 2025 Economic & CRE Outlook webinar with a panel of industry leaders discussing the macro environment, the potential policies of the new administration and tariffs, affordable housing, tax policy expectations and more.

Tariffs

- Proposed Tariffs: Trump has signaled a desire to implement sweeping tariffs, including a 25% tariff on goods from Mexico and Canada that could go into effect on Feb. 1. Trump has also considered a universal 20% tariff on all imports and a 60% tariff on China. (CNN, Jan. 21)

- These measures are aimed at boosting domestic manufacturing and addressing trade imbalances but could have ripple effects on construction costs and material availability. Any tariffs on imported materials like steel, aluminum and lumber are likely to drive up costs for developers and impact efforts to address the housing shortage. (BisNow, Jan. 17)

- The scale and scope of the President’s tariff plans are in flux. Trump’s advisors have reportedly considered a phased-in tariff approach. It’s also possible that Trump makes use of the White House’s exemption authority to protect certain industries or goods deemed vital. (Bloomberg, Jan. 13)

Regulatory Work

- President Trump also signed an executive order freezing all ongoing regulatory work across the federal government, halting the proposal or publication of new rules until reviewed and approved by his administration.

- The freeze delays the effective date of recently published rules by 60 days, allowing time to decide which Biden-era regulations to keep, rewrite, or discard. (National Law Review, Jan. 23)

- As with many other parts of the U.S. financial regulatory framework, the pending Basel III Endgame proposal may end up being reproposed with a capital neutral scheme, giving a potential boost to liquidity and credit capacity under the new Trump administration.

Disaster Aid and NFIP Extension

- California Fires: Congress and the new administration will soon need to provide billions of dollars in aid to assist those affected by the Los Angeles wildfires. The catastrophe could reach up to $275 billion, with then of thousands of homes and businesses will need to be rebuilt, making federal assistance essential. (Roundtable Weekly, Jan. 17)

- NFIP: The increasing severity of natural disasters—including the devastating hurricanes last year—has increased the importance of the National Flood Insurance Program (NFIP), whichis set to expire on March 14 unless reauthorized. The Senate Banking, Housing and Urban Affairs Committee held a hearing on Thursday to discuss the program’s renewal. (Politico, Jan. 22)

Housing

- Fannie Mae and Freddie Mac Privatization: Trump’s team is expected to resume efforts to privatize the government-sponsored enterprises (GSEs), which could significantly reshape multifamily financing markets.

- Trump has nominated Bill Pulte, to lead the Federal Housing Finance Agency (FHFA), which oversees the GSEs—a move experts say is part of Trump’s push towards privatization. (CRE Daily, Jan. 17)

- Deregulation to Spur Housing Development: Trump has pledged to roll back environmental and building regulations that hinder housing construction. This includes streamlining permitting processes, relaxing restrictions and accelerating project timelines.

- Trump’s nominee for the Department of Housing and Urban Development (HUD), Scott Turner, has pledged to cut regulations that he says are stifling development. These efforts aim to increase housing supply, particularly in high-demand markets. (BisNow, Jan. 17)

Immigration and Labor

- Deportations: Trump’s plans for mass deportations could have significant effects on the housing industry. Immigrants make up over 25% of the construction laborer workforce in the U.S., an industry where more workers are sorely needed—especially if affordable housing goals are to be met. (Bisnow, Jan. 17)

- Depending on the extent of Trump’s deportation plans, CRE projects may face rising costs and delays if the construction workforce is severely affected. (NBC News, Jan. 21)

- According to the Associated Builders and Contractors, the construction industry needs 439,000 new workers this year to meet rising demand. The need for construction resources is urgent, with Los Angeles requiring rebuilding after devastating fires and a nationwide surge in data center construction on the horizon. (Axios, Jan. 24)

Energy and Infrastructure

- Emergency Powers: On the day Trump took office, he declared an energy emergency—giving the White House new authority to speed up the manufacture of certain products under the Defense Production Act, issue waivers on certain gasoline restrictions and restrict energy trade, among other powers—likely in service of Trump’s stated effort to “drill, baby, drill.” (The Hill, Jan. 20)

- Data Centers: Trump also announced a $500 billion “Stargate” initiative designed to expand AI-focused data center infrastructure. The executive order prioritizes the use of fossil fuels to power these facilities and streamlines permitting processes for large-scale projects. (AP News, Jan. 22)

- The investment could help hasten the buildout of high-demand data centers, which are limited by the availability of energy resources and infrastructure. (BisNow, Jan. 22)

Looking Ahead

With the whirlwind of activity coming out of the Trump administration and Congress, RER will continue to proactively evaluate policy developments as legislative efforts and White House implementation of executive orders progress.