A bipartisan measure to address the growing stress on the nation’s electricity grid could see a window for opportunity in Congress’s lame-duck session after the November 5 elections. The Energy Permitting Reform Act of 2024 (S. 4753), co-sponsored by Senate Energy Committee Chairman Joe Manchin (I-WV) and Ranking Member John Barrasso (R-WY), would streamline approvals for major energy development projects amid increasing demands for power.

Why it Matters

- Permitting reform has been a bipartisan priority reflected by more than two dozen bills introduced by both parties in the 118th Congress.

- S. 4753 aims to streamline reviews and permitting processing for energy infrastructure. Expediting approvals for pending and new projects are long-standing goals for renewable energy companies, as well as the oil and gas sector.

- With Senator Manchin retiring at the end of his current term, the bill could be a capstone to his legislative legacy. He has urged Senate Majority Leader Chuck Schumer (D-NY) to bring it to the floor before year-end. (E&E News, Sep. 23)

- Leader Schumer (D-NY) told reporters in July, “I’d like to get permitting reform done.” (The Hill, July, 26)

- The bipartisan bill has its controversies. While climate advocates argue that the bill’s fossil fuel provisions could lock in emissions for decades, others point to the need for large-scale clean energy supplies and grid reliability. Third-party analyses indicate that even with these fossil fuel provisions, the bill would ultimately lead to net emissions reductions.

- The Roundtable believes permitting reform is essential for advancing our economy’s energy transition. The current fragmented system of environmental reviews and approvals hinders progress on launching new projects and delivering cleaner, reliable electricity to our nation’s buildings.

The High Stakes for U.S. Grid

- America’s power grid is under increasing strain as the digital economy accelerates.

- Data centers, AI, and electric vehicles are all demanding more power. Current infrastructure is not equipped to handle it.

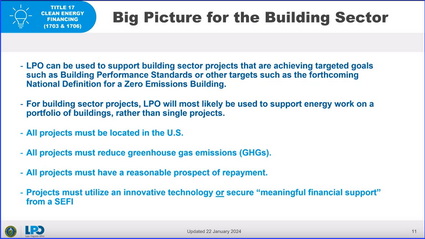

- As The Roundtable’s recent Policy Guide on building performance standards states, the transition to a digital economy raises serious concerns about electricity availability. “AI could soon need as much electricity as an entire country” as “[v]ast swaths of the US are at risk of running short of power.” (Roundtable Weekly, Oct. 11)

- A Wood Mackenzie report predicts that parts of the U.S. could see a 15% jump in power demand by 2030—posing major challenges for an already-stressed grid. (Politico, Oct. 18).

- According to the latest CBRE North America Data Center Trends study, the rapid growth of AI, coupled with soaring demand for cloud services, has driven a 70% surge in data center construction across the US over the past six months—along with an unrelenting need for the electricity to power them. (Cybernews, Aug. 20)

- Without permitting reform, meeting this growing demand will become more difficult and expensive. (Forbes, Sep. 2)

Congress returns to Washington in a matter of weeks and has the opportunity to pass the Energy Permitting Reform Act and address these grid challenges.