Dual Republican House and Senate resolutions introduced this week take aim at the recent climate risk disclosure rule from the U.S. Securities and Exchange Commission (SEC). As the 2024 election season gets underway, the resolutions delineate the parties’ different views on climate policy and their clashing perspectives on the scope of agencies’ regulatory authority. (Senate and House resolutions | PoliticoPro, April 17)

Political Differences

- The partisan effort to overturn the SEC’s rule will not garner significant support from Democrats and the resolution is unlikely to pass the Senate. However, the resolutions have rallied Republicans to advance their message that the Biden administration’s SEC frequently steps outside the bounds of its regulatory authority. (The Hill and Bloomberg Law, April 17)

- Banking Committee Ranking Member Tim Scott (R-SC) leads the effort in the Senate. “The SEC’s mission is to regulate our capital markets and ensure all Americans can safely share in their economic success — not to force a partisan climate agenda on American businesses,” he said in a statement.

- Scott’s resolution has the support of 33 Republicans. Sen. Joe Manchin (D-WV) is the lone Democrat co-sponsor. (PoliticoPro, April 17).

- Democratic support for the SEC’s rule includes Senate Banking Committee Chairman Sherrod Brown (D-OH). “I applaud the SEC for acting to address climate risks to protect workers, investors, and our economy,” Brown said after the SEC rule was released last March. (Senate Banking news release)

- On the House side, Financial Services Committee Republicans advanced a similar resolution along a party-line vote on April 17. Committee Member Bill Huizenga (R-MI) introduced the House resolution. (Climate Wire, April 18)

Legal Pause in Effect

- Numerous lawsuits challenging the SEC’s rule are now consolidated in federal court. The SEC agreed to stay its climate rule while litigation is pending. (Climate Wire, April 5)

- House Financial Services Committee Chairman Patrick McHenry (R-SC) said “[t]he SEC’s stay of the rule is not enough” and that congressional action is warranted, crystallizing the political nature of the issue.

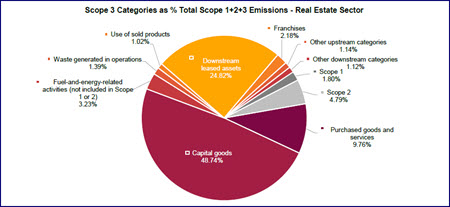

If the SEC’s rule eventually takes effect, registered companies would have to include certain climate-related disclosures in annual Form 10-Ks. Notably, the final SEC rule did not include Scope 3 disclosures, which affirmed a position strongly advocated by The Roundtable. (Roundtable Fact Sheet, March 12 and Roundtable Weekly, March 8)

# # #