Housing Hearing

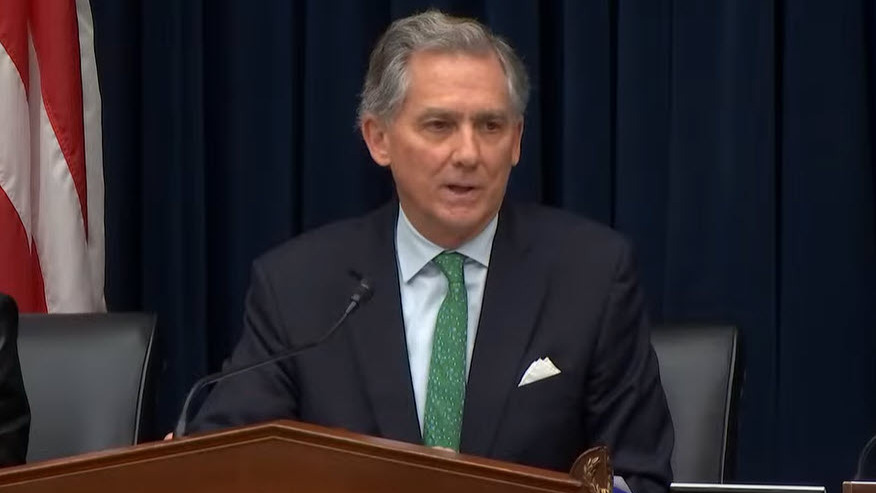

- The House Financial Services Committee examined regulatory obstacles driving the nation’s housing shortage during a hearing, “Building Capacity: Reducing Government Roadblocks to Housing Supply.”

- Lawmakers and witnesses focused on zoning limits, lengthy permitting timelines, and other local and federal policies that restrict new construction and inflate costs. (Committee Press Release, Dec. 3)

- Committee Chair French Hill (R-AR) said during the hearing the committee will assemble a housing and banking package later this month aimed at cutting red tape, strengthening community bank lending to homebuilders, and creating a more predictable development environment for builders, lenders, buyers, and renters. (Politico, Dec. 3)

- Throughout the hearing, witnesses emphasized the need to cut red tape, streamline local permitting, and address workforce, tariff, and energy-rule cost pressures, while emphasizing the expansion of manufactured housing as a critical supply solution.

- National Association of Realtors Immediate Past President Kevin Sears testified that zoning prohibitions and regulatory barriers at all levels restrict many communities from allowing diverse housing types. He added that lengthy permitting processes further slow development, and that federal incentives to encourage local governments to streamline approvals would be highly beneficial. (Watch Hearing; Committee Memo)

- Ahead of the hearing, lawmakers noticed 41 housing bills—several supported by The Real Estate Roundtable (RER), including the HOME Reform Act of 2025 and the Housing Supply Frameworks Act, with the common goal of increasing housing supply, growing jobs, and modernizing our nation’s critical infrastructure.

State of Play

- The Senate Banking Committee has its own bipartisan housing policy package, the Renewing Opportunity in the American Dream (ROAD) to Housing Act of 2025 (S. 2651), which passed in October as part of its version of the National Defense Authorization Act (NDAA). (Roundtable Weekly, Oct. 17)

- GOP leaders are now considering whether to add a revised or scaled-down version of the Senate’s legislation to the NDAA, but no final decisions have been made. (PoliticoPro, Dec. 3)

- Chair Hill cautioned that members have not yet reviewed any legislative text and emphasized that the committee must be fully engaged in negotiations. He said in a statement late Wednesday that “any housing package must have the buy-in” of his committee. (PoliticoPro, Dec. 3)

Senate Housing Legislation

- This week, Senators John Cornyn (R-TX), Michael Bennet (D-CO), Steve Daines (R-MT), Adam Schiff (D-CA), John Barrasso (R-WY), and Mark Kelly (D-AZ) introduced the More Homes on the Market Act, which would make housing more available and affordable by amending the tax code to allow sellers to exclude additional funds from capital gains taxes, incentivizing homeowners to sell and increasing market supply. (Sen. Cornyn Press Release, Dec. 3)

- The More Homes on the Market Act would increase the exclusion to $500,000 for single filers and $1 million for joint filers, making it more financially desirable for homeowners to sell and increasing housing turnover.

- “The American dream is rooted in owning a home and raising a family, but an outdated tax code not only prevents the next generation from being able to afford a home, but it also prevents seniors seeking to downsize from selling theirs,” said Sen. Cornyn. “This legislation would update the tax code to incentivize sellers and make homes more affordable, and I’m glad to support it.”

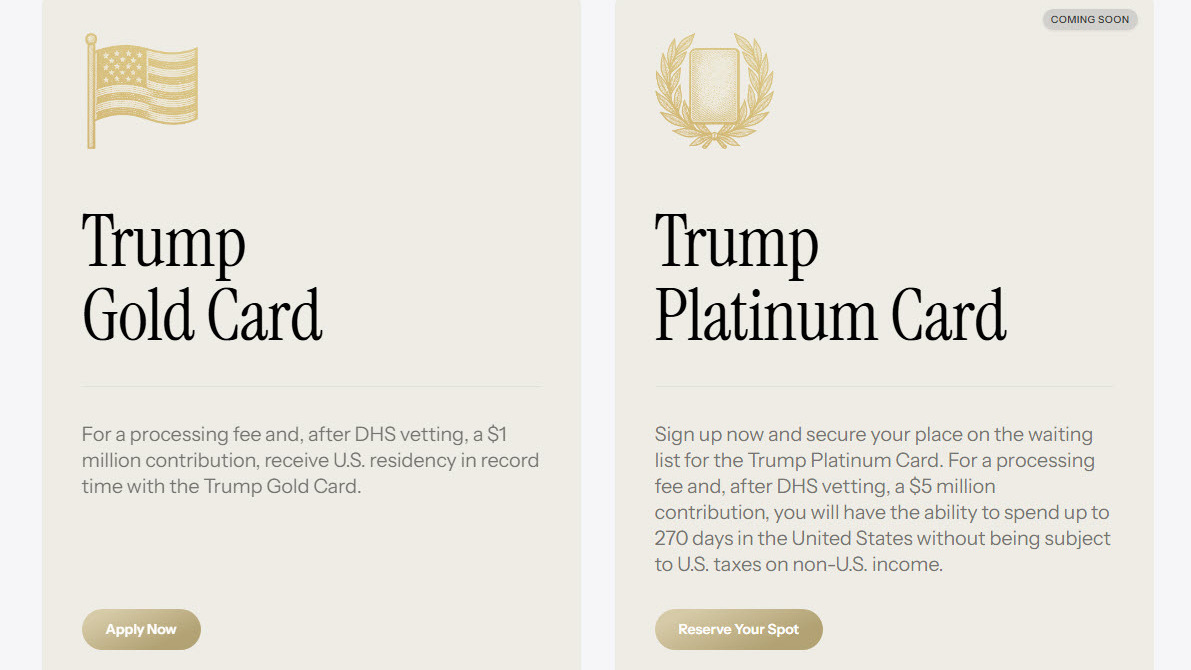

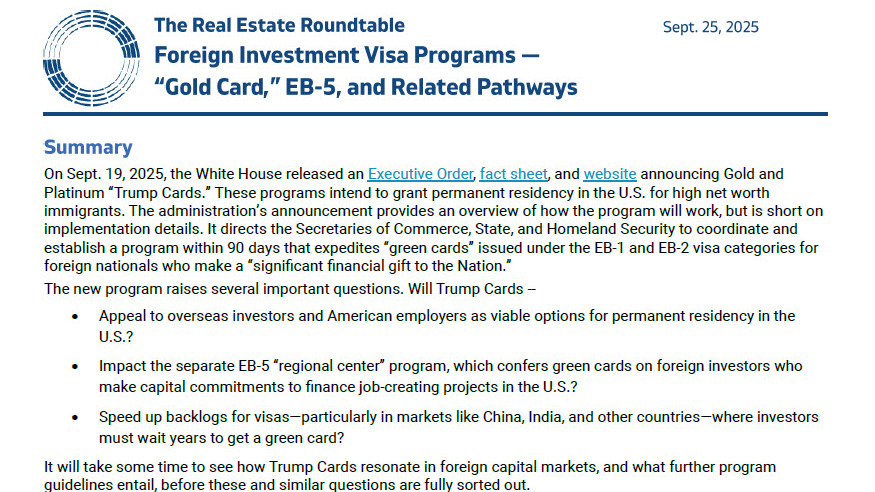

EB-5 & Workforce

- Sen. Gallego (D-AZ) introduced the Building Housing for the American Dream Act this week, a bill that would redirect foreign capital from the EB-5 program into affordable housing construction. (Sen. Gallego Press Release, Dec. 4)

- The bill would extend the lower $800,000 investment threshold to projects dedicated to the production, preservation, or rehabilitation of housing and would expedite processing for applications linked to affordable housing. (Bloomberg, Dec. 4)

- “Creative policy solutions must be on the table to increase the housing supplies we need to address the national affordability crisis” said Jeffrey D. DeBoer, President and CEO of The Real Estate Roundtable.

- “Senator Gallego’s Building Housing for the American Dream Act hits the mark. It recognizes that housing should be treated as infrastructure. It will attract overseas investment capital through the EB-5 visa program, helping to build more homes in markets across the country where there are serious housing shortages. It will accomplish these goals at no cost to taxpayers, and create jobs for American workers. This is a smart bill that should be included in long-term EB-5 reauthorization. We thank Senator Gallego for his leadership.” (Sen. Gallego Press Release, Dec. 4)

RER will continue engaging with policymakers and industry leaders to promote bipartisan solutions and regulatory reforms that expand housing supply, improve affordability, and strengthen economic stability.