The House Financial Services Committee introduced a bipartisan housing package, the Housing for the 21st Century Act on Thursday, aimed to streamline housing development and improve affordability by updating outdated programs, removing unnecessary federal requirements, and increasing local flexibility. (One-pager; Text of the bill; Section-by-Section)

Housing for the 21st Century Act

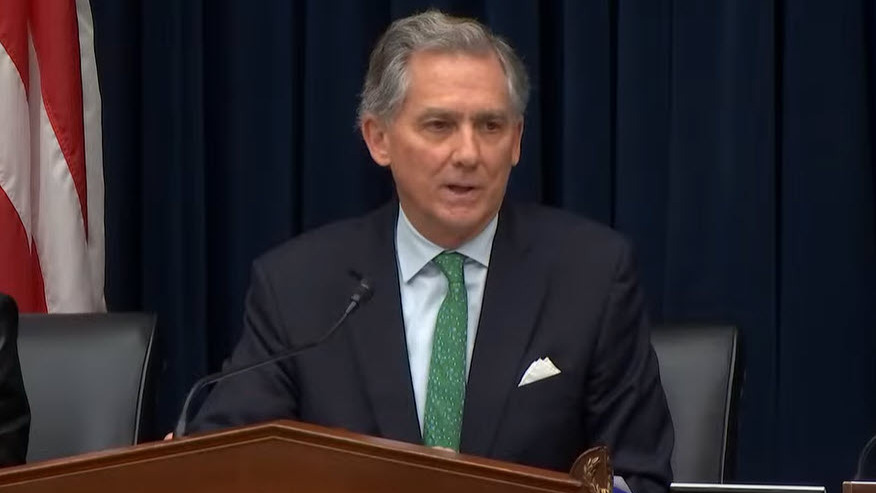

- House Financial Services Chairman French Hill (R-AR), Ranking Member Maxine Waters (D-CA), Subcommittee on Housing and Insurance Chair Mike Flood (R-NE) (who will be speaking at the joint RECPAC/Research Committee meeting on Jan. 21), and Subcommittee on Housing and Insurance Ranking Member Emanuel Cleaver (D-MO) unveiled the bipartisan legislation Thursday, proposing targeted updates to HUD programs, expand manufactured and affordable housing, and modernize local and rural development tools.

- Chairman Hill said, “Our goal is to chart a path forward toward greater development capacity and a simplified regulatory framework. We look forward to moving this bill through regular order and working with our Senate counterparts in the new year to get a bill signed into law that reflects ideas from both chambers and delivers real results for American families.” (Press Release, Dec. 11)

- Subcommittee Chair Flood added, “As housing gets more expensive, the American Dream of homeownership is slipping away for working families. This package is the product of bipartisan work in the Financial Services Committee to address some of the core issues driving up the cost of housing.”

- The committee plans to integrate aspects of the Senate’s Renewing Opportunity in the American Dream (ROAD) to Housing Act of 2025 (S. 2651) with additional measures from the House Financial Services Committee.

- One major distinction in the House bill is a provision to overhaul the HOME Investment Partnerships Program. (WashingtonExaminer, Dec. 11)

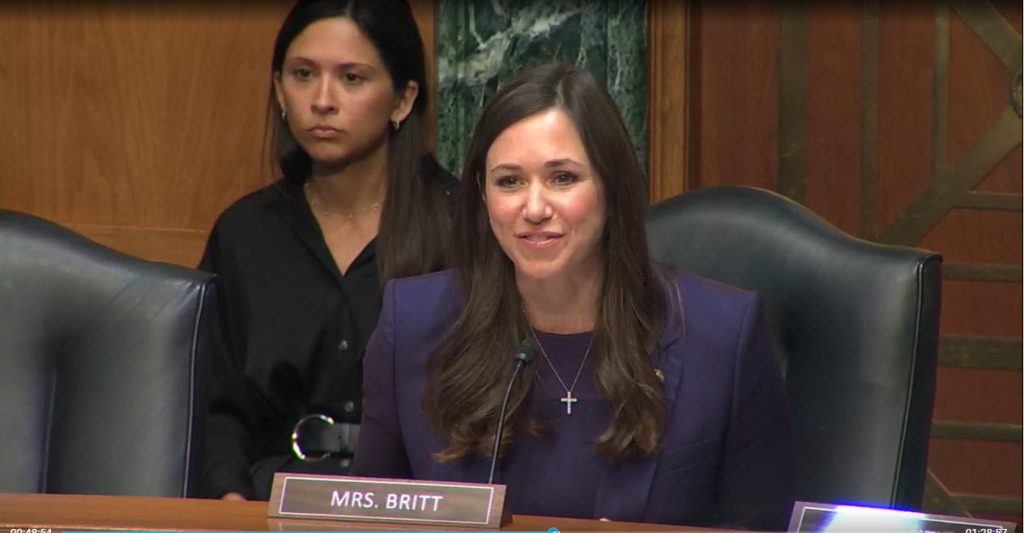

Senate – ROAD to Housing Act

- The ROAD to Housing Act was ultimately excluded from the final text of the 2026 National Defense Authorization Act. (HousingWire, Dec. 8)

- The bill incentivizes states and cities to boost housing supply by cutting red tape, streamlining federal inspections, and eliminating duplicative regulations. (Roundtable Weekly, Oct. 17, Aug. 1 )

- The Senate’s bipartisan package advanced earlier this year with unanimous committee support in July and received full Senate approval in October, but House Republicans signaled they wanted more flexibility to advance their own housing legislation. (Multifamily Dive, Dec. 10)

- Ranking Member Waters stated, “While I was disappointed ROAD was not included in the NDAA, there is clearly broad bipartisan support in both Chambers to advance housing legislation.”

The House Financial Services Committee intends to mark up its housing package next week, along with 20 other bills on the National Flood Insurance Program and community banking, among others. (PoliticoPro, Dec. 11)