Summary

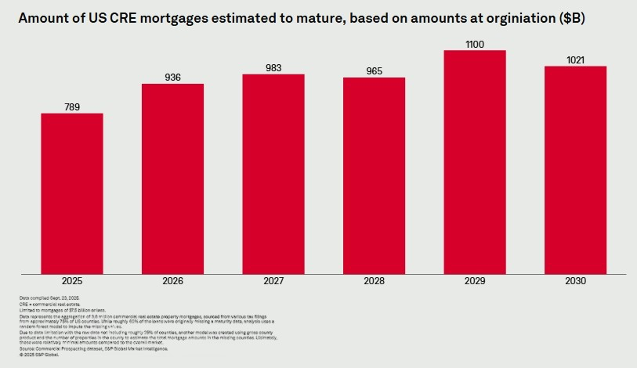

Nearly $936 billion of U.S. commercial real estate mortgages are estimated to mature in 2026. To help rebalance the wave of maturing loans, it is important to advance measures that will encourage additional capital formation and loan restructuring.

It is also important to avoid pro-cyclical regulatory actions such as the Basel III Endgame.

A revised Basel III Endgame proposal announced in September 2024 would have increased Tier 1 capital requirements for global systemically important banks by roughly 9 percent. Concerns remain that any increase in capital requirements will have a pro-cyclical impact on credit capacity and carry a cost to commercial real estate and the overall economy, increasing the cost of credit and constraining capacity. Implementation remains uncertain.

In a January 2024 letter, RER raised industry concerns about the negative impact of the Basel III Endgame proposal, including the higher cost of credit and diminished lending capacity, and requested that the proposal be withdrawn.

Vice Chair for Supervision Michelle Bowman said that the central bank is working with the FDIC and the OCC on reproposal of the rule. A more industry-friendly version of contentious capital rules is expected in early 2026.

In a Dec. 19, 2025 letter to Vice Chair Bowman and other bank regulatory agencies, House Financial Services Committee Chairman French Hill (R-AR) urged regulators to design the Basel III Endgame capital rules in a way that protects bank safety without unnecessarily restricting credit or harming economic growth, while supporting households, businesses, and markets.

Key Takeaways

Providing banks with the flexibility to work constructively with their borrowers during times of economic stress has led to billions of dollars of loan restructurings and reduced undue stress in bank loan portfolios.

The original Basel III Endgame proposalwould have had a significant economic cost without clear benefits to the economy.

The largest U.S. banks’ capital and liquidity levels have grown dramatically since the original Basel III standards were implemented in 2013 in response to the 2008 Global Financial Crisis. Since 2009, Tier 1 capital has increased by 56 percent and Common Equity Tier 1 capital has tripled. Today, as the Federal Reserve recently observed, the U.S. “banking system is sound and resilient, with strong capital and liquidity.”

Further, it is important to bring more foreign capital into U.S. real estate by lifting legal barriers to investment, as well as repealing or reforming the archaic Foreign Investment in Real Property Tax Act (FIRPTA).

See the full fact sheet.

Withdraw the Proposal to Increase Capital Requirements: While well-intentioned, we are concerned that the proposals could increase the cost of credit, diminish lending capacity, and undermine the essential role banks play in lending and financial intermediation for real estate.

Support Robust Capital Formation: Additional capital is called for to help restructure and transition the ownership and refinancing of commercial real estate from a period of low rates to a time of higher rates. Additional capital is an essential element to this restructuring, and enacting policies that will encourage robust capital formation is imperative.

Basel III Endgame